Master the Past, Shape the Future

Next-gen portfolio management software for private equity.

rapid deployment

Most portfolio management systems still leave firms navigating through manual processes, which can lead to delayed or reactive decision-making. Harness the power of AI to streamline data collection and analysis to access forward-looking insights that enable your firm to anticipate trends and adjust strategies proactively rather than merely compiling historical financial reports.

- Go from manual to automated across funds in a week

- Track KPIs from multiple departments across the business

- No more digging through board decks and excel files

- Zero interruptions to current business flow

- Normalise & process data using AI

- Unlimited Integrations

Unparalleled Insights Without an

Army of Analysts

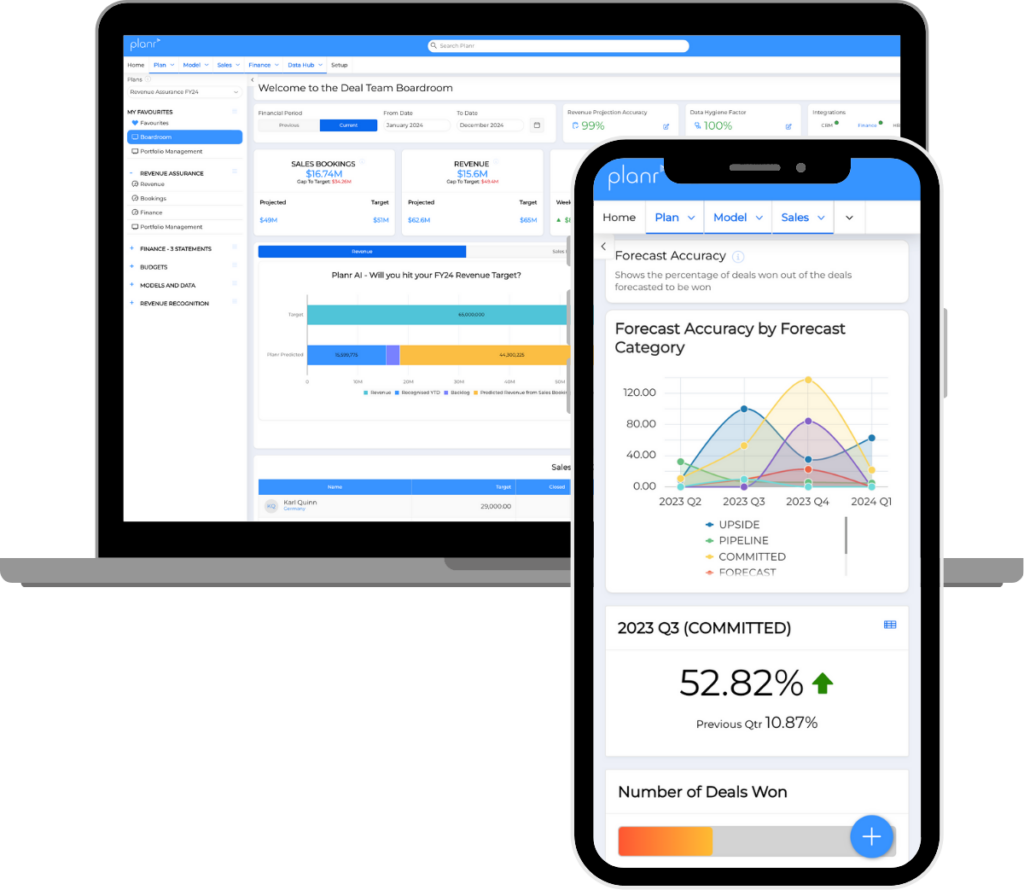

Portfolio monitoring

Establish a robust data-driven foundation by integrating key financial data effortlessly.

Value Creation

Layer in CRM data, unlocking a forward-looking perspective on your portfolio’s performance.

Ai-powered Insights

Compare performances, utilize predictive analytics and establish robust fund reporting.

LP reporting

Effortlessly customize and automate your LP reports, maintaining full control over stakeholder communications.

ESG Reporting

Centralize ESG data and customize your reports to meet evolving standards while maintaining complete control.

Secure Data Management

Safeguard your data with enterprise-grade technology, encrypted transmissions, and continuous monitoring.