Portfolio Monitoring | Value Creation | Valuations

The AI Operating System

for Private Equity

Here's What Makes

Planr Different.

Everyone Else

Shows you what happened.

Shows you what's going to happen.

They Give You

Dashboards.

We Give You

Answers.

We tell you why those numbers are what they are, and what you need to fix.

Most Platforms Use ChatGPT

Your portfolio data, going through commercial models.

No security guarantees. Hallucinating results.

That's insane.

We Built Our AI Into Our Platform

Your data stays yours.

Enterprise-grade security. Real SLAs.

And you talk to it.

Like you're talking to

your smartest analyst.

Natural language.

No training.

No complexity.

Excel Hell

Spreadsheets, PDFs, board decks

scattered everywhere.

One Place. One Truth.

We take all of it. Structured data from your systems,

unstructured data from your documents.

Speed Matters.

Our competitors take months to implement.

We get you live fast.

We Built the Entire Platform

Not Point Solutions.

Not Cobbled-Together Tools.

One system.

Most Platforms

Help you understand the past.

Helps you create the future.

That's the Difference.

Trusted by Leading Investment Firms

A Single Platform for

Private Company Investors

Some of the best investors in the world are flying blind. They're managing multi-billion dollar portfolios with spreadsheets and quarterly reports, discovering problems 60 days too late when they are 3x harder to fix. Planr changes that.

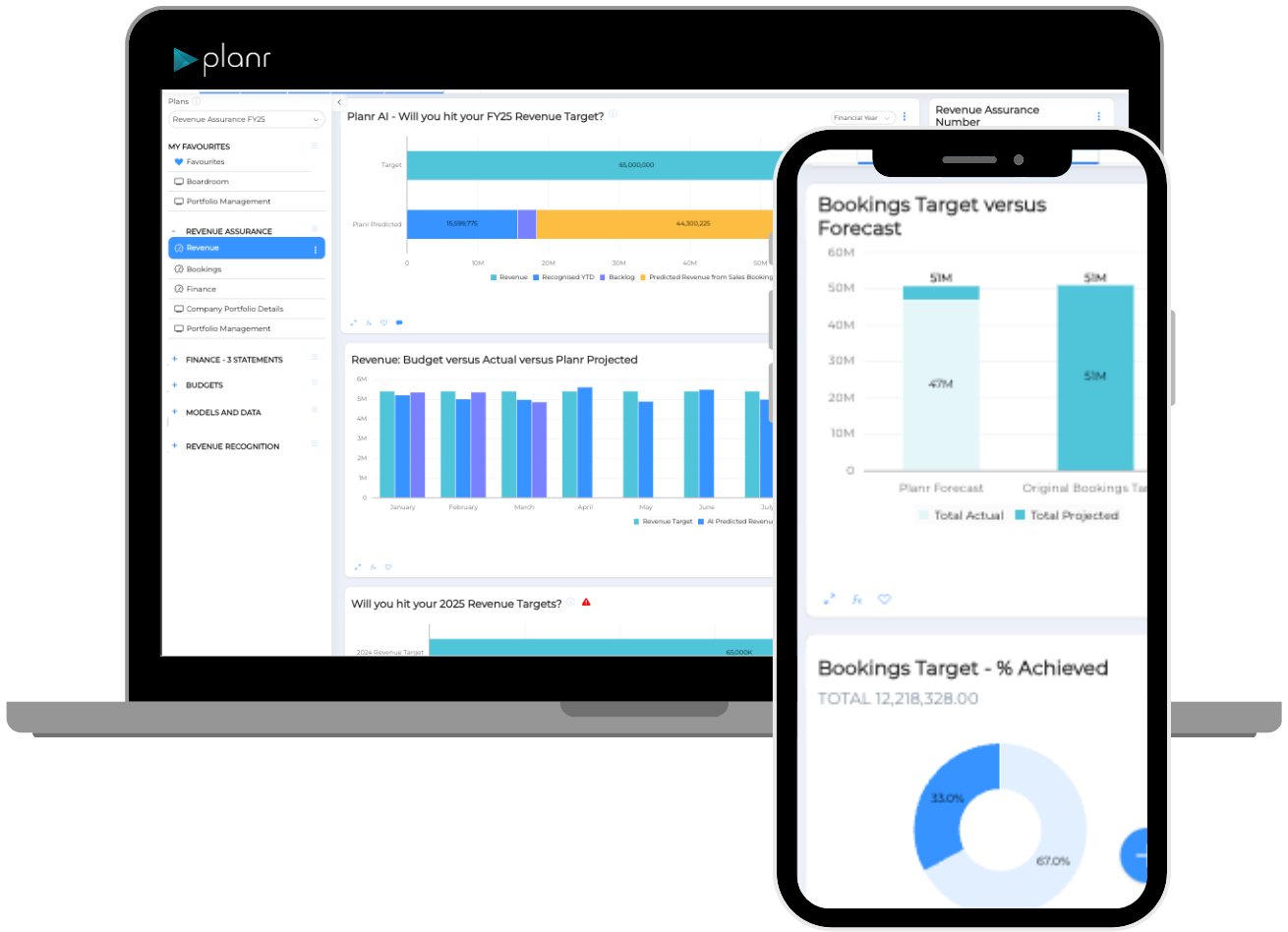

Planr Omnia

Planr Omnia gives you real-time intelligence across portfolio monitoring, value creation, and valuations. Make better decisions faster, no waiting for quarterly reports or board meetings to spot what matters. AI-powered insights, predictive forecasting, and enterprise-grade infrastructure, all accessible through a natural language interface. Just ask.

3 Core Modules

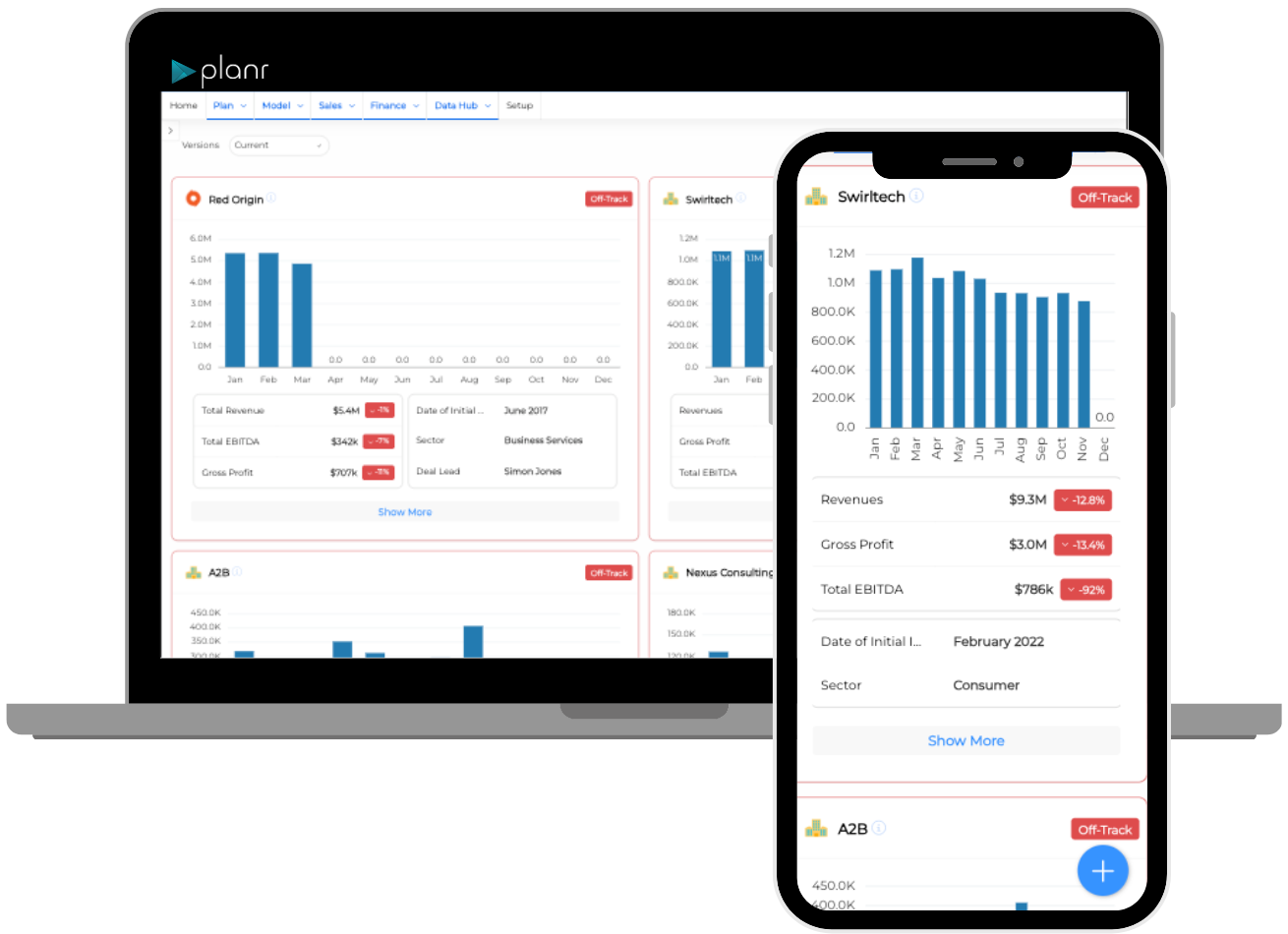

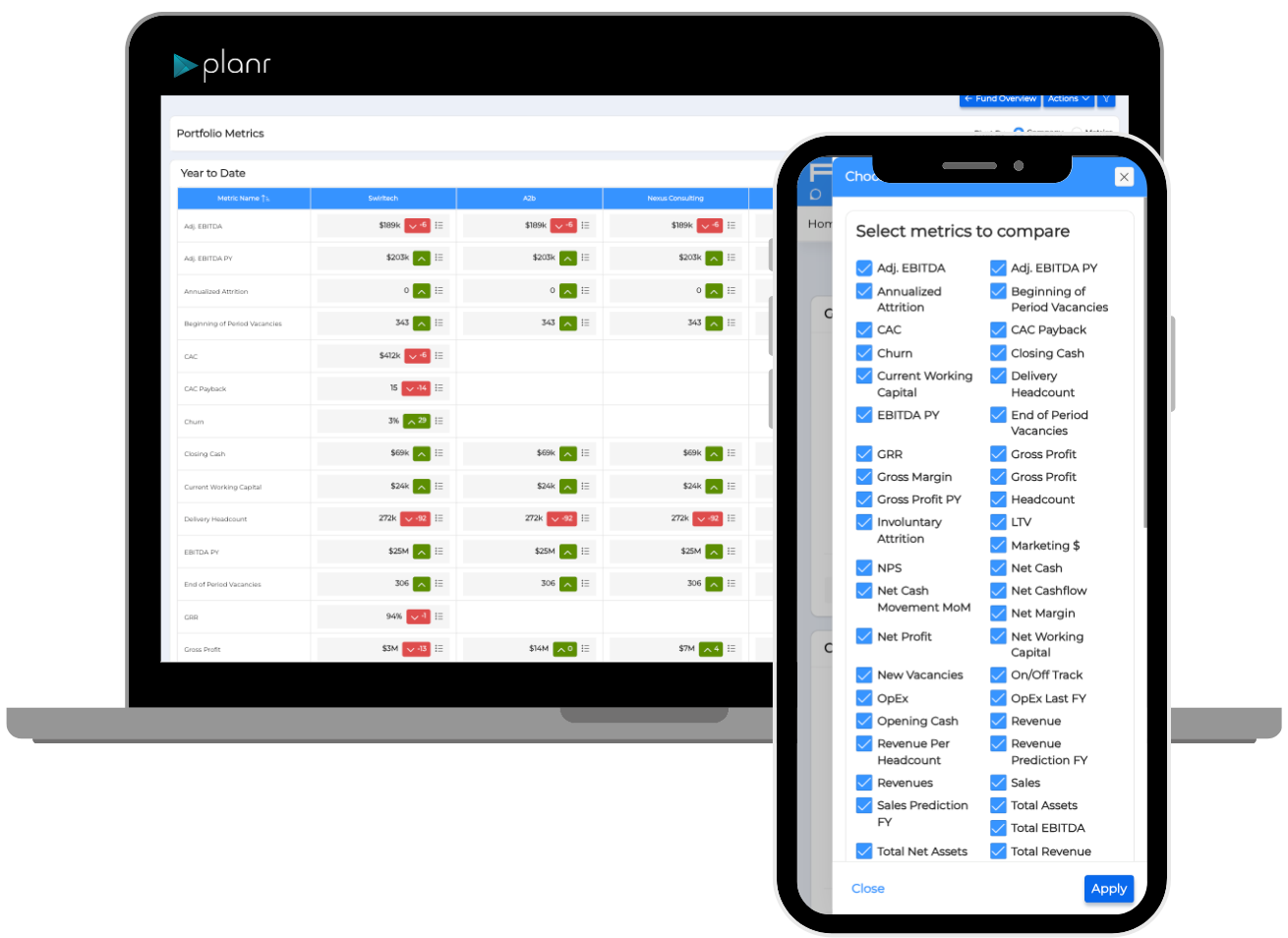

Portfolio Monitoring+

Combines traditional portfolio monitoring view of P&L with forward-looking powerful ML driven projections.

Value Creation

Identify specific growth levers and optimization opportunities within each company. In Sales, HR and key initiatives.

Valuations

Automated calculation and reporting of portfolio valuations. Full flexibility for your team to report data onto multiple chart of accounts.

Portfolio Monitoring+

See where your portfolio companies have been and understand where they're headed.

Unified P&L visibility: Across all portfolio companies with standardized and custom chart of accounts mapping

Predictive ML forecasting: Identifies variance patterns 60-90 days before they appear in reported financials

Automated anomaly detection: Flags revenue misses, cost overruns, and operational inefficiencies in real-time

Scenario modeling: Understand impact of headcount changes, budget adjustments, or operational initiatives on future performance

Rapid deployment: Integrated with existing data sources and operational in weeks, not months

Value Creation

Identify specific growth levers and optimization opportunities within each company across the pillars of value creation.

Sales optimization: Pipeline health analysis, win rate tracking, sales cycle efficiency, and rep performance benchmarking

GTM execution monitoring: Track customer acquisition costs, payback periods, and channel effectiveness across portfolio

HR and organizational alignment: Headcount planning, compensation benchmarking, attrition risk prediction, and talent density analysis

Revenue operations excellence: Billing efficiency, collections optimization, and revenue recognition accuracy

Initiative tracking: Real-time visibility into 100-day plans, strategic projects, and value creation milestones with automated progress updates

Valuations

Centralized, automated valuation calculations across your entire portfolio.

Dynamic valuation calculations: Full flexibility for multiple methodologies (revenue multiples, EBITDA multiples, DCF, comparable transactions)

Custom formula engine: Define and apply your firm's proprietary valuation approaches across the portfolio

Multi-chart of accounts support: Report the same underlying data across different frameworks for internal reviews, LP reporting, and regulatory compliance

Automated report generation: Quarterly valuations, IC memos, and LP updates with audit trail documentation

Waterfall modeling: Understand distribution scenarios and carried interest calculations at current and projected valuations

Why We Exist

For the founders who started it, the teams who drive it, and the investors who put their money on the line to build it: Planr is the platform that helps you create something bigger.

We keep you ahead of your data - from operating your initial dream, through scaling that reality, to the freedom that comes with a successful exit.

We exist to deliver that.

Here's What Makes Planr Different

Historical & Future-Looking Intelligence

We do all the historical P&L analysis that traditional portfolio management systems can do, but we also tell you what will happen based on your data and use these insights to plan what will happen next.

Natural Language Interface

No training required. Ask questions in plain English and get instant, actionable answers from your entire portfolio.

One Source of Truth

All your structured and unstructured data unified in a single platform, eliminating data silos and reconciliation headaches.

Predictive ML Models

Machine learning engines that don't just show historical trends - they forecast what's coming so you can act before it's too late.

Enterprise-Grade Security

Your portfolio data stays secure with bank-level encryption and compliance standards. No data leakage, ever.

Rapid Deployment

No twelve-month implementations. No million-dollar consulting fees. Get up and running in weeks, not years.

Experience the Future of

Portfolio Intelligence

Ask Planr Anything

See Planr Omnia in Action

Join leading PE firms using AI to transform portfolio intelligence. Book your personalized demo today.

Great! Now Choose a Day and Time

Select a convenient time for your personalized demo with our team.