Turn Portfolio Data Into Stronger Exits for your Fund

Maximize portfolio value, streamline operations, and strengthen investor relationships – all on a single AI-powered platform built for PE.

AI That Thinks Like a Private Equity Partner

Planr is the only AI-native platform that gives you real-time, portfolio-wide intelligence – no spreadsheets, no PDFs, no delays. Seamlessly connect to your portfolio companies and uncover insights that drive smarter, faster decisions.

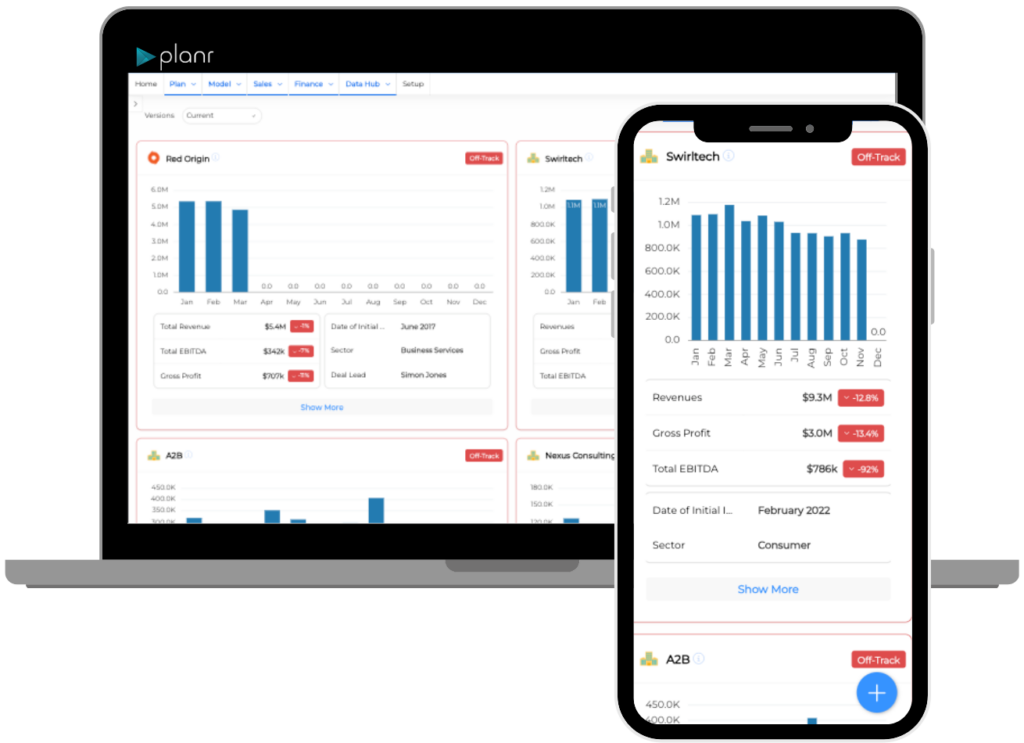

Complete Visibility. Instantly.

Planr eliminates the complexity of portfolio monitoring with automated data flows, live performance tracking, and AI-powered analytics. Get a real-time, 360° view of fund and company performance—without the manual work.

With a single, unified platform, you can monitor financials, sales, and operations in one place, ensuring full transparency, faster insights, and smarter collaboration across your portfolio.

- Real-Time Data & Reporting: Instant access to portfolio and fund performance—no spreadsheets, no delays.

- Effortless Data Flow: Fully automated data collection and integration, eliminating manual uploads.

- Seamless Deployment & Scalability: Up and running in days, integrating with your existing systems.

- Remove Human Error & Bias: Data-driven intelligence replaces gut feel, ensuring smarter, more objective decisions.

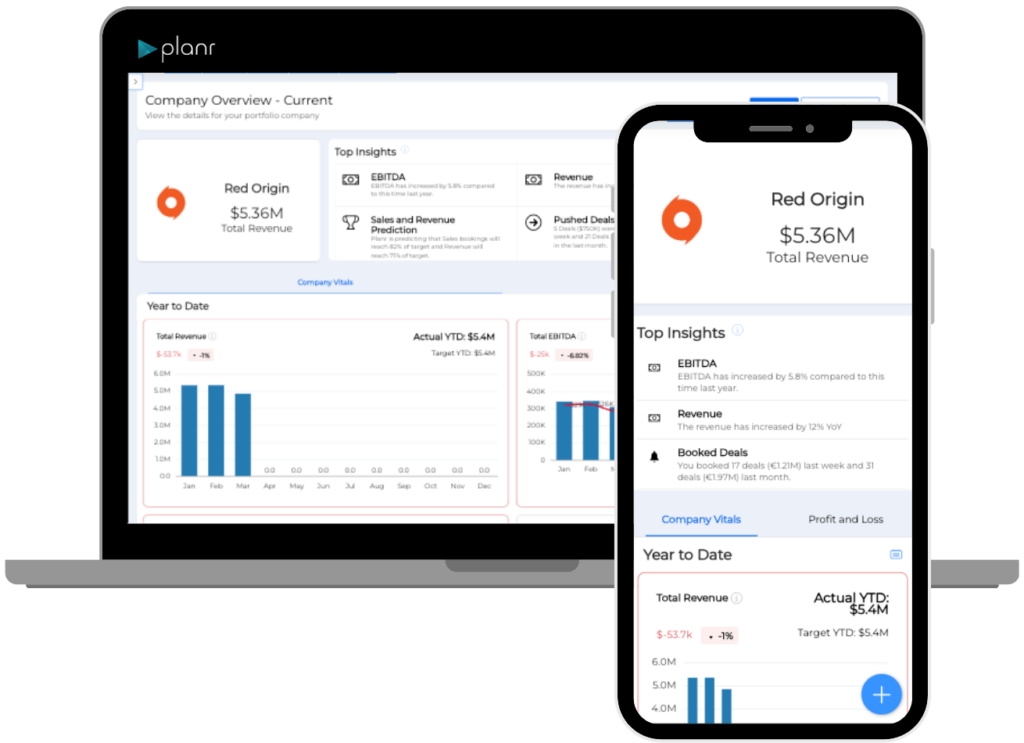

Value Creation, Supercharged by AI.

Go beyond static reporting and unlock the real drivers of performance across your portfolio. Instead of reacting to problems after they surface, stay ahead with AI-driven insights that track deal momentum, revenue shifts, and operational efficiency—without manual effort.

With automated alerts and smart recommendations, Planr pinpoints risks and opportunities before they impact returns. Drill into company, team, and deal-level data with real-time intelligence, so you can act with confidence, not just report on the past.

- Identify Performance Trends: Our AI uncovers early indicators of growth or decline across portfolio companies.

- Drill Down to the Details: Access granular insights into sales, financials, and team execution at a company level.

- Real-Time Monitoring & Alerts: Know the moment performance shifts—no more waiting for end-of-quarter reports.

- Proactive, Not Reactive: Move beyond reporting and make data-backed decisions that drive value creation.

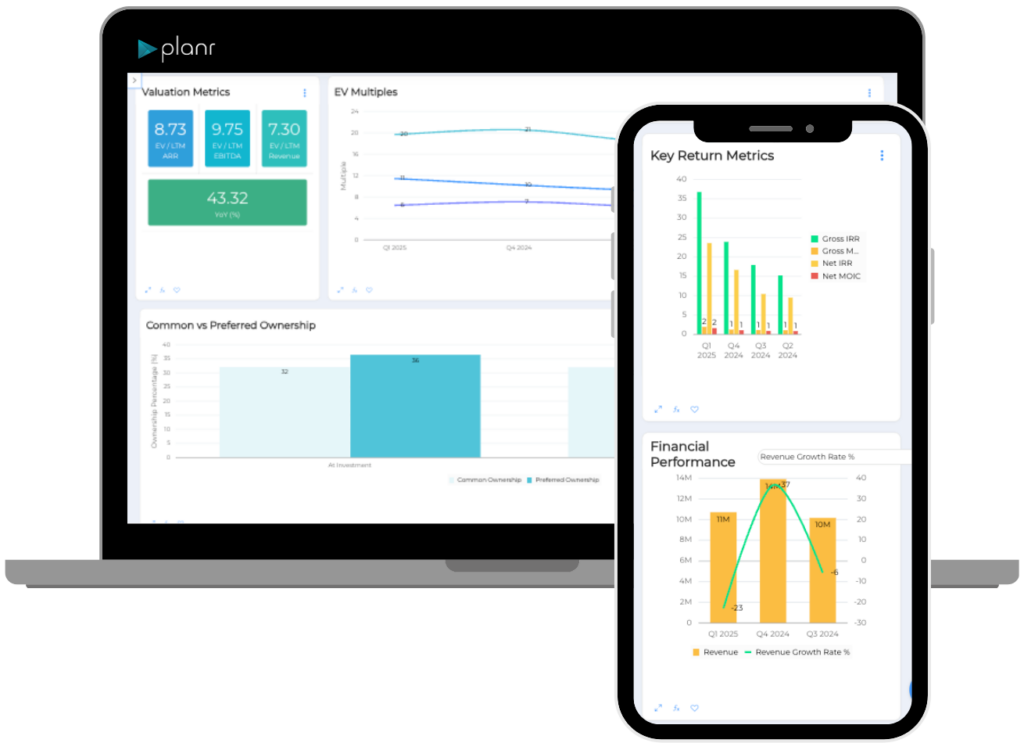

AI-Powered Valuations: Faster, Smarter.

Traditional valuations are slow, manual, and prone to inconsistencies. Planr automates the entire valuation process, using AI to streamline fair value assessments, scenario modeling, and real-time adjustments. No more waiting on static reports—get instant, audit-ready valuations across your portfolio.

With seamless integration into financial, operational, and market data, Planr ensures your valuations are always up-to-date, data-driven, and aligned with compliance standards. Make valuation decisions with confidence, backed by real-time intelligence.

- AI-Driven Valuations: Automate fair value assessments with real-time data, eliminating manual calculations.

- Scenario Modeling: Instantly model different valuation outcomes based on changing financial and market conditions.

- Portfolio-Wide Consistency: Standardize valuation methodologies across all portfolio companies for accurate, comparable insights.

- Audit-Ready Reporting: Ensure compliance with industry standards and investor expectations through transparent, AI-powered valuation processes.

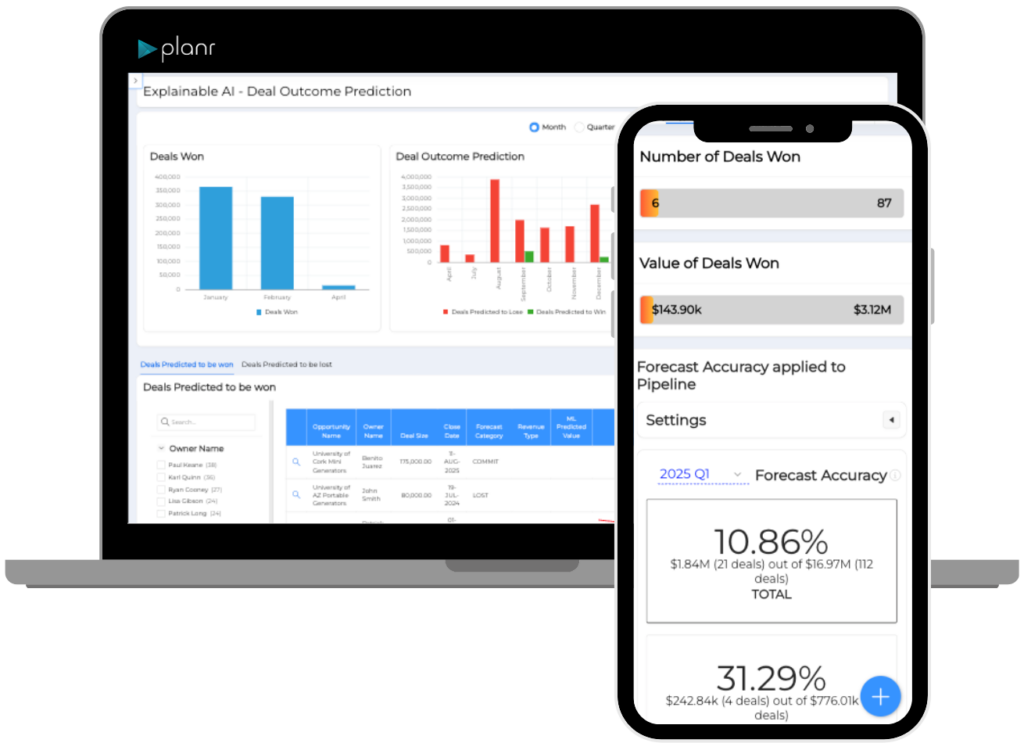

No More Surprises At Board Meetings.

Stop relying on outdated spreadsheets and backward-looking reports. With Planr, forecasting happens in real-time—at both the company and fund level. AI-powered models track revenue, sales, and cash flow across individual portfolio companies, rolling them up into a single, accurate forecast of fund performance.

Whether you’re evaluating growth projections, investment returns, or liquidity planning, Planr provides real-time scenario modeling so you can adjust strategies instantly. Know what’s ahead—before it happens.

- AI-Powered Forecasting: Predict revenue, sales, and cash flow at the company level—then roll it up to see full fund performance.

- Scenario Planning in Real-Time: Model different outcomes instantly to test fund-wide impacts and make proactive decisions.

- Portfolio-Wide Visibility: View forecasting at both individual portco and aggregated fund levels, ensuring a unified strategy.

- Data-Driven Capital Allocation: Confidently allocate resources with AI-driven insights that highlight risk, opportunity, and optimal investments.

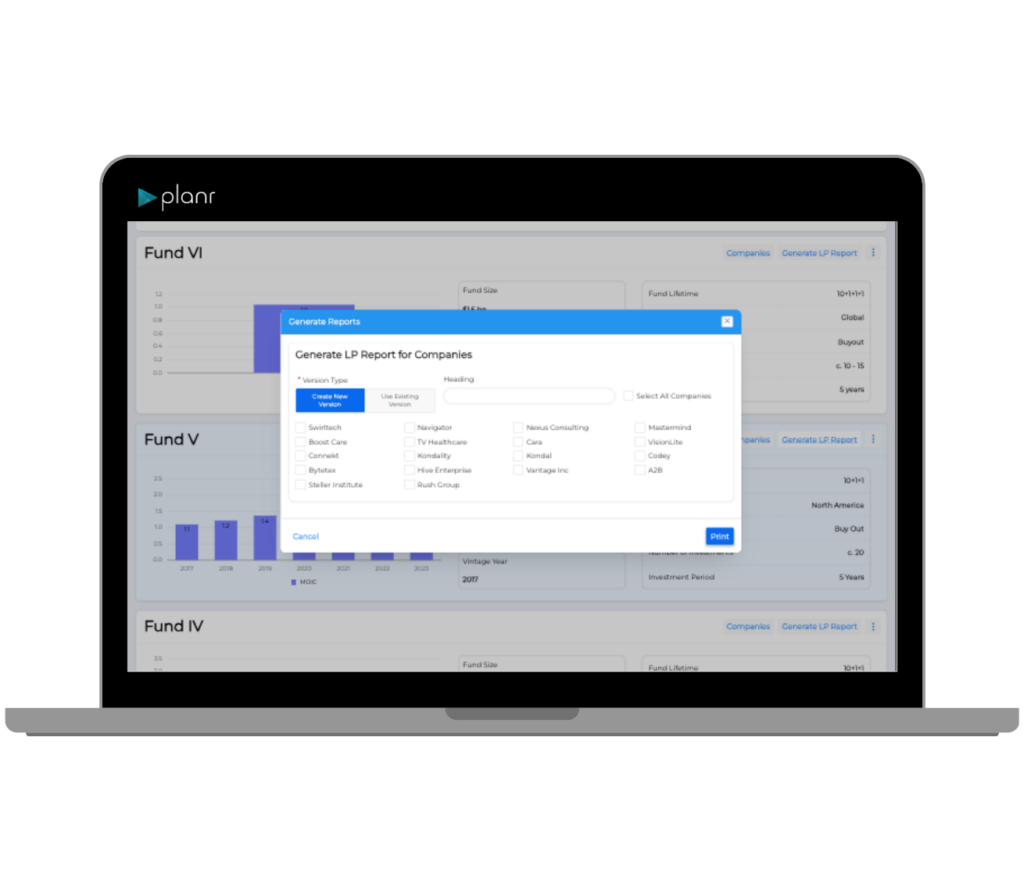

Effortless LP Reporting, Instant Investor Insights.

Responding to Limited Partner requests shouldn’t be a bottleneck. Planr’s LP Reporting Suite automates data collection, report generation, and investor servicing—giving you a single source of truth for all fund and portfolio insights.

With customizable templates, real-time data syncing, and automated report updates, Planr ensures that LPs receive accurate, up-to-date information in seconds. No more chasing internal teams, digging through emails, or copy-pasting into Excel.

- Automated LP Reporting: Instantly generate investor-ready reports—no manual data entry or formatting.

- Custom Query Scraper: Quickly respond to LP requests with tailored insights—without waiting on internal teams.

- Real-Time Data Syncing: Reports dynamically update as new information flows into the platform—ensuring accuracy.

- Audit-Ready Compliance: Maintain version histories and track disclosures to eliminate ambiguity in investor communications.

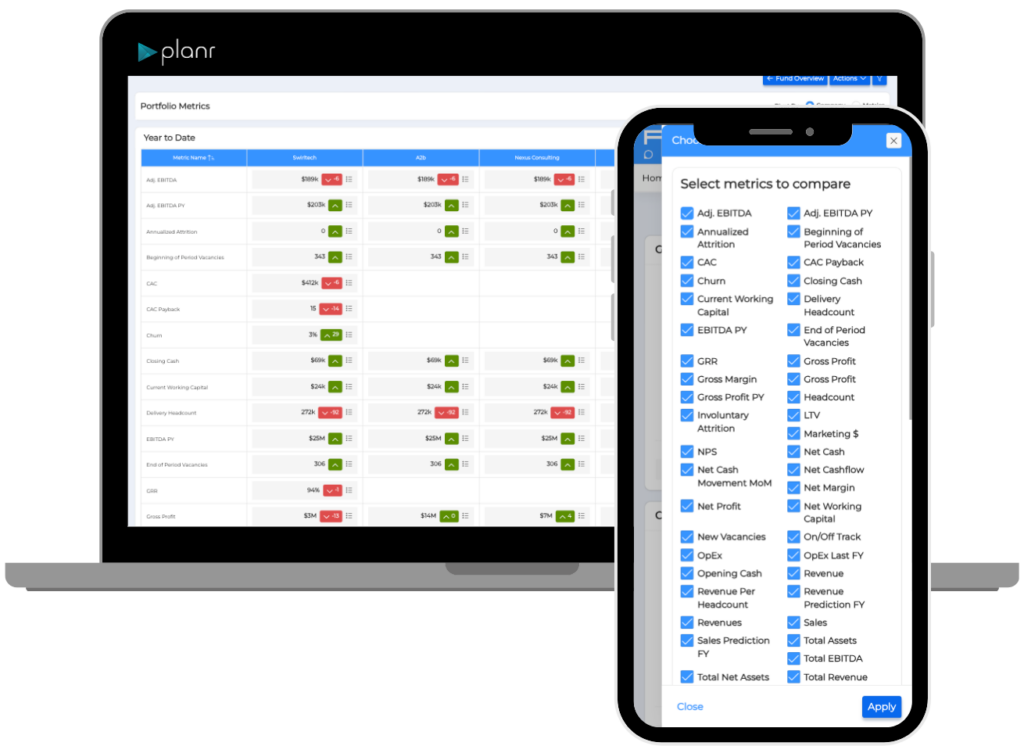

Smarter Comparisons, Sharper Decisions.

Comparing portfolio performance shouldn’t be a guessing game. Planr’s Investment Benchmarking delivers real-time, data-driven comparisons against industry standards, historical trends, and custom KPIs—so you know exactly where your portfolio stands.

With automated data aggregation and AI-powered insights, you can measure financial performance, operational efficiency, and value creation across companies, funds, and sectors. Make confident investment decisions backed by real-time benchmarking, not outdated reports.

- Industry & Peer Comparisons: Benchmark portfolio companies against industry averages and competitor performance.

- Real-Time Portfolio Insights: Track financial, operational, and market trends with always up-to-date data.

- Customizable Performance Metrics: Define and monitor KPIs that align with your investment strategy and value creation goals.

- AI-Powered Trend Analysis: Identify emerging risks and opportunities before they impact portfolio performance.

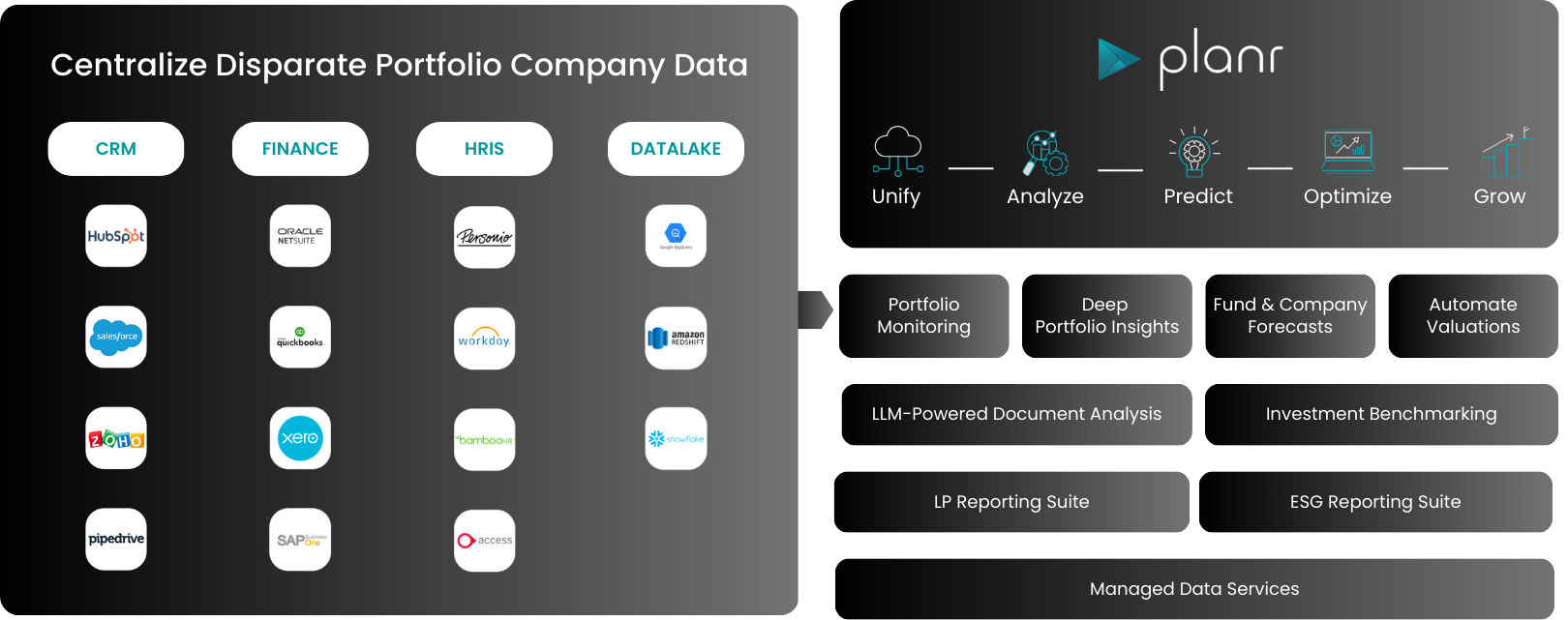

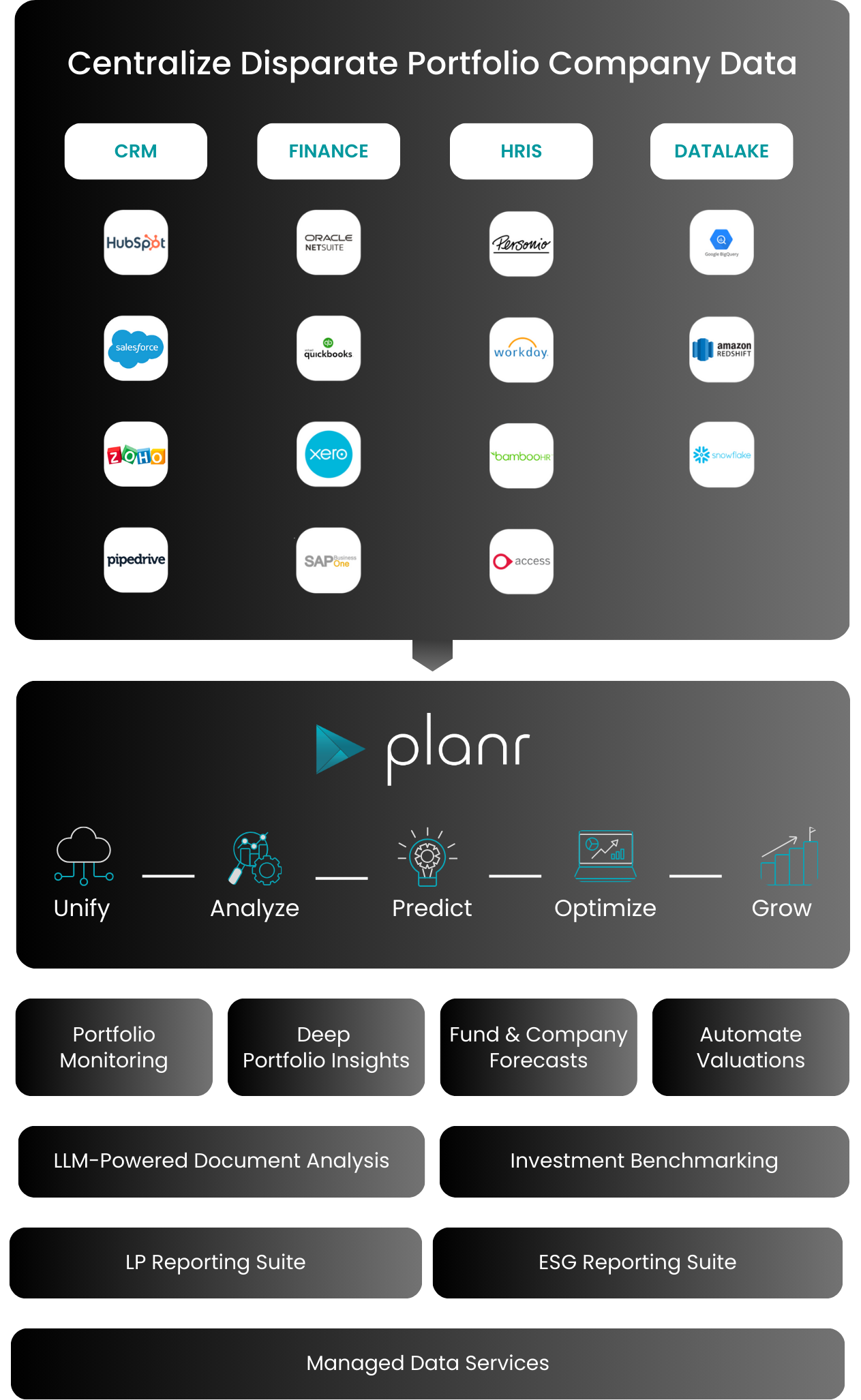

Turn Data Chaos into Competitive Advantage

Planr is the only AI-native platform that integrates directly with portfolio companies.

Make Smarter

Decisions Faster

Don’t just react—predict. Identify risks and course-correct with confidence.

Eliminate Manual

Reporting Workflows

Automate tedious tasks and focus on value creation.

Rapid Results,

Minimal Disruption

Deploy in hours to and drive value-creation in real-time.

Deliver Investor Confidence

Based On Evidence

Provide LPs with on-demand, evidence-backed performance insights.

One Platform,

Zero Blind Spots

Eliminate silos and uncover insights you can act on, instantly and effortlessly.

Scale Without

Complexity

A single source of truth across your entire portfolio.

Break Free from Legacy Limitations

The old way of portfolio monitoring slows you down. Planr puts you ahead with real-time insights, AI-driven forecasting, and seamless collaboration—so you can act, not react.

- Direct Data Access: Real-time API connections to portco data—no templates, no PDFs.

- AI-Driven Decisions: Predictive analytics, scenario modeling, AI-powered forecasts.

- One Unified Ecosystem: GPs, LPs, and portcos collaborate on one seamless platform.

- Portfolio-Wide Intelligence: Drill down to granular metrics across finance, sales, and marketing.

- Faster, Simpler Setup: Fully operational in days, not months—seamlessly integrates with your existing tech stack.

- Built for Value Creation : Proactively identifies growth drivers and risks in real-time.

Competitors

- Manual Data Collection: Data is uploaded via templates, PDFs, or Excel sheets.

- Backward-Looking Reports: Static reports with no predictive insights.

- Fragmented Systems: GPs and LPs use separate tools with limited visibility.

- High-Level Overviews Only fund-level metrics, no granular portco insights.

- Lengthy Onboarding Requires IT involvement and months-long implementation.

- Passive Monitoring: Focuses on historical tracking, not proactive value creation.

Built for the Future of Private Equity

We love Planr’s configurability and integration capabilities and we are increasingly looking to leverage the intelligent analytics layer.

For any tool to be useful, it has to be a real part of the day-to-day workflow. Planr is becoming the enabler for all of that. Whether it’s reporting to investors or managing day-to-day operations, having up-to-date performance data at our fingertips is critical.

Anup Hira

Partner & Value Creation Team Lead

The detailed insights and predictions have not only enhanced our strategic planning but have also been instrumental in maintaining a 30% YoY revenue growth rate. Planr has brought a new level of sophistication to our sales and revenue operations. As we shifted market focus, getting forecast predictability was vital.

We were able to access insights that are impossible to get from Salesforce.

David Beausang

VP Sales & Customer Success

Planr has shifted our behaviour in Calligo. If we are at risk of missing a revenue target, I know about it. I now have the insights and time to intervene and course correct before our sales or revenue performance is impacted.

Using Planr we have an objective view of the impact of decisions taken across the business on sales and revenue performance and its future trajectory.

Julian Box

Chief Exective Officer

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making