Insights

AI in Private Equity: Progress, Pitfalls, and What Comes Next

Artificial intelligence has moved rapidly from hype to reality in private equity. General partners (GPs) are already experimenting with AI across the deal lifecycle – from origination and due diligence to portfolio monitoring and reporting – while limited partners (LPs) are starting to follow.

Artificial intelligence has moved rapidly from hype to reality in private equity. General partners (GPs) are already experimenting with AI across the deal lifecycle – from origination and due diligence to portfolio monitoring and reporting – while limited partners (LPs) are starting to follow.

A recent article in Private Equity International highlighted just how quickly this shift is happening. The majority of GPs now rank AI as a top strategic priority, citing benefits such as efficiency gains, better data and reporting, improved decision-making, and stronger risk management. LPs are also beginning to explore practical use cases in areas like portfolio monitoring, deal sourcing, and performance analysis.

But the same article underscored an important reality: adoption isn’t without friction. Firms are enthusiastic about AI, but challenges around accuracy, trust, and security remain.

Adoption is Accelerating

GPs are leading the charge. Many are already seeing value in areas like fund accounting, portfolio management, and investor reporting. AI is helping them cut through manual processes, surface insights faster, and strengthen their communication with stakeholders.

LPs, while more cautious, are moving in the same direction. According to PEI, a growing number are actively considering AI adoption once proven use cases are clear. For some, the appeal lies in being able to screen opportunities faster and gain deeper visibility into portfolio risks and opportunities.

The momentum is undeniable: AI is no longer a question of if but how fast.

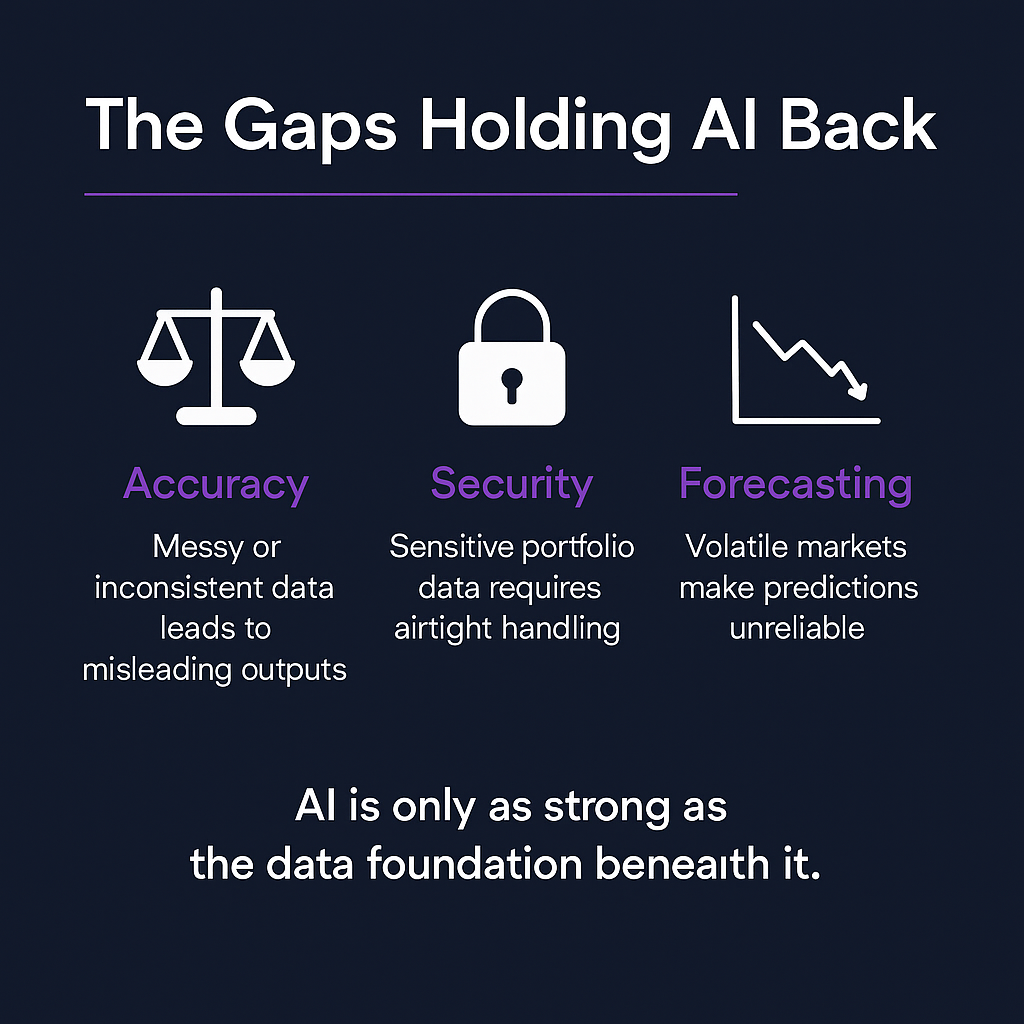

The Gaps Holding AI Back

Despite the optimism, significant hurdles remain. PEI reports that concerns around accuracy of outputs, security, and reliability of forecasting are top of mind for both GPs and LPs.

- Accuracy of Outputs: Without validated, standardized data, AI risks producing misleading or incomplete insights.

- Security & Privacy: Sensitive portfolio and investor data requires airtight handling, and firms remain cautious about where and how AI fits into those workflows.

- Forecasting Limitations : While AI promises sharper predictions, volatile markets and inconsistent inputs make accurate forecasting difficult.

Why Data Comes First

This is where many funds are struggling. AI can’t solve for messy, inconsistent data on its own. If portfolio companies report in different formats, across different systems, and with varying levels of detail, AI is left trying to piece together a fragmented picture.

That’s why the conversation needs to begin with data standardization and integration. With a single source of truth in place, AI can finally deliver on its promise – driving real-time, evidence-based insights that guide decision-making and create value.

Planr’s perspective

AI is the engine. But without high-quality data as fuel, it can’t deliver value.

At Planr, we see AI not as a replacement for strong processes, but as an amplifier of them. Our platform centralizes and standardizes data across portfolio companies, creating a clean, consistent base for AI to operate with confidence.

- Faster, more accurate reporting across the fund.

- Real-time visibility into portfolio and company performance.

- Insights that withstand scrutiny from LPs, boards, and regulators.

What’s next for AI in PE

Private equity is at an inflection point. As Private Equity International highlighted, adoption is gaining momentum across both GPs and LPs – but success will depend on overcoming the implementation gaps that remain.

The firms that win won’t just be the ones that “adopt AI.” They’ll be the ones that build the foundations for AI to thrive – clean data, flexible workflows, and trusted reporting.

At Planr, we believe that’s the real story of AI in private equity: not hype, not shortcuts, but the practical infrastructure that makes AI useful, reliable, and transformative.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making