Insights

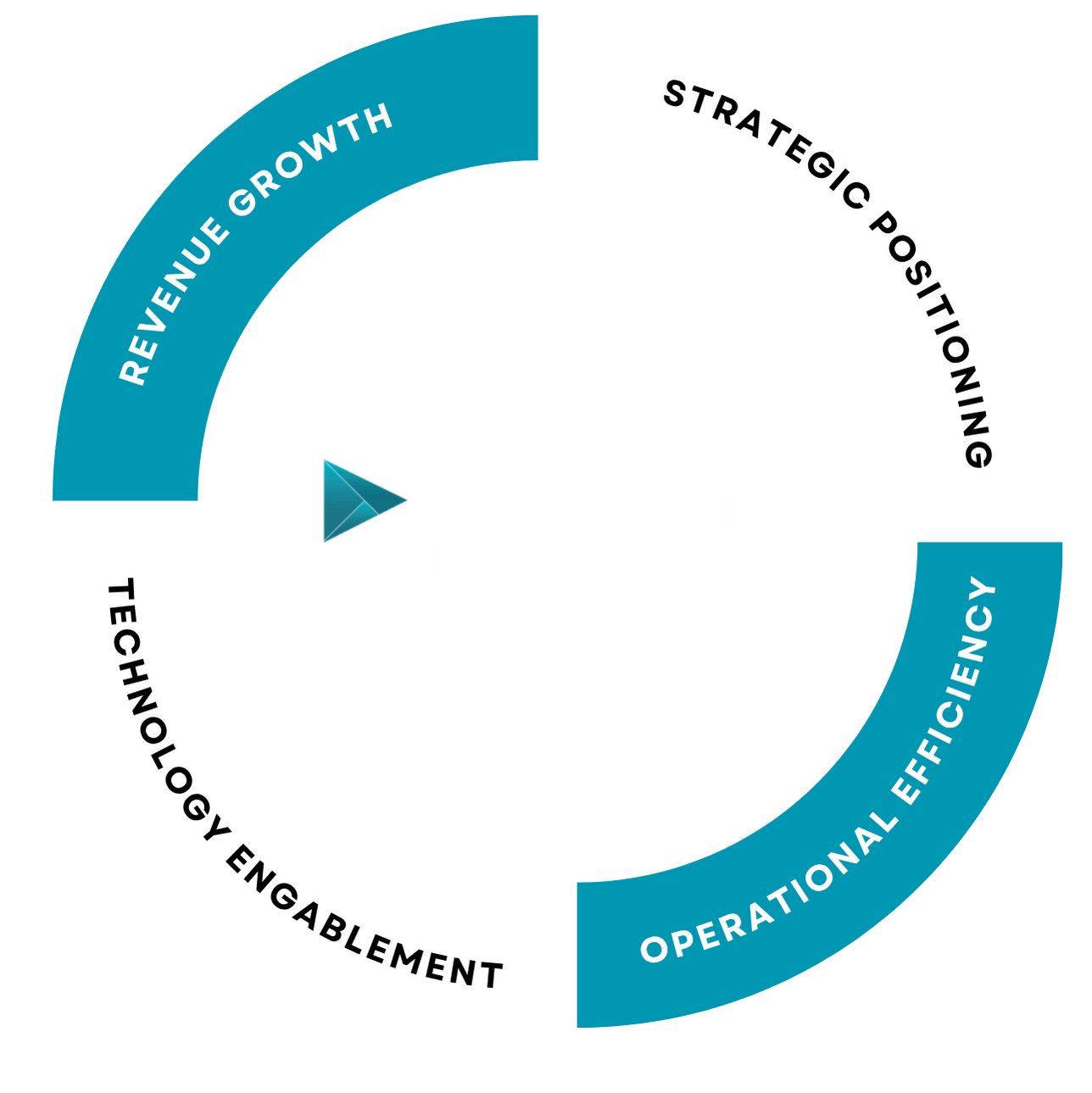

The Four Pillars Powering Value Creation in Modern Private Equity

Private equity has always been about value creation — but the playbook has changed.

The Shift from Monitoring to AI-Driven Value Creation

Leading firms are no longer content with tracking performance — they’re leveraging enterprise-grade systems and AI that create performance engines. The next era of value creation will be powered by AI and driven by four core pillars.

The levers that once delivered outperformance are now under pressure from longer hold periods, operational complexity, and the need for faster, data-backed decisions. At Planr, we see a clear shift: the firms leading the next decade of private equity are those building institutional-grade capabilities around four core pillars of value creation — and using AI to power them.

- Revenue Growth

- Strategic Positioning

- Operational Efficiency

- Technology Enablement

Revenue Growth

Building Predictable, Data-Driven Growth Stories

Top-performing funds are no longer focused only on cutting costs; they’re engineering predictable, repeatable growth. Planr enables full RevOps visibility across the portfolio, integrating CRM, ERP, and financial data into one view.

This helps funds to:

- Surface cross-sell and upsell opportunities faster.

- Identify which portfolio companies are excelling – and why.

- Build credible, data-backed growth stories for LPs and buyers.

The result: growth that’s measurable, defensible, and scalable.

Strategic Positioning

Sharpening the Equity Story

When it comes to exit readiness, story and substance must align. Planr’s benchmarking and automated reporting capabilities help portfolio companies quantify their equity story -highlighting recurring revenue, scalability, ESG, and efficiency gains with clean, standardized data.

This enables funds to:

- Present a portfolio that’s “exit ready.”

- Strengthen buyer and LP confidence with real-time visibility.

- Position portfolio companies for multiple expansion.

By unifying data across companies, funds can demonstrate the institutional quality of their operations – a mark of top-quartile performance.

Operational Efficiency

Digitizing and Automating the Work That Slows Growth

Manual data collection, spreadsheet reconciliations, and inconsistent reporting are still among the biggest sources of lost time and hidden risk in PE operations.

Planr replaces these manual workflows with digitized, automated processes that standardize reporting across the portfolio and eliminate dependency on error-prone Excel models.

Funds using Planr reclaim hundreds of hours every quarter, enabling CFOs and operating partners to focus on strategy – not spreadsheet management.

Technology Enablement

Building the Backbone of the Modern PE Firm

True scalability starts with the right data foundation.

Planr provides an AI-powered unified data cloud, creating a single source of truth across CRM, ERP, and operational systems.

That means:

- Every decision is based on accurate, governed data.

- AI surfaces anomalies and opportunities in real time.

- New acquisitions can be integrated into the reporting model in days, not months.

It’s the scalable infrastructure that allows funds to professionalize operations and future-proof their portfolios.

The Results Speak for Themselves

A unified, AI-driven foundation for sustainable, scalable growth.

This year, Planr has welcomed Five Elms Capital, Crossplane Capital, and CGE Partners to our growing community of forward-thinking funds. Each is using Planr to unify data, standardize performance reporting, and accelerate value creation, not just monitor it. Their adoption reflects a powerful industry shift: from passive reporting to active enablement of value creation through AI.

Private equity will always be about finding and growing value – but the firms who win the next cycle will be those who do it faster, with cleaner data and clearer visibility across the portfolio.