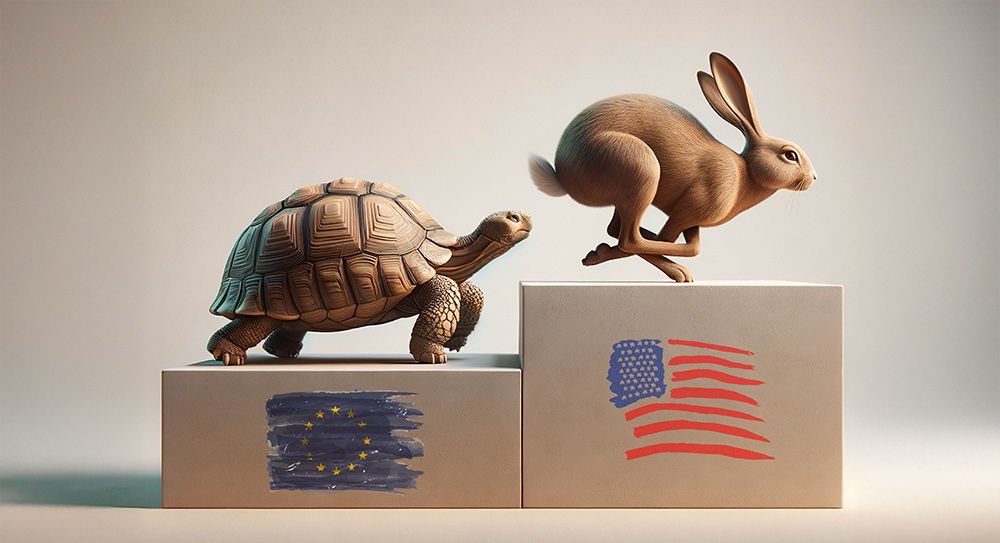

Bridging the AI Gap in Private Equity:

USA vs Europe

Artificial Intelligence (AI) is rapidly transforming the private equity (PE) landscape, driving efficiency, enhancing decision-making, and unlocking new growth opportunities. However, European General Partners (GPs) are significantly trailing their US counterparts in AI adoption.

A 2024 survey revealed that while AI usage in PE has grown by 40% year-over-year, only 4% of European GPs have implemented AI extensively, compared to 26% in the US. Regulatory hurdles, limited infrastructure, and a talent shortage are major factors contributing to this gap.

Regulation: A Double-Edged Sword

Europe’s cautious regulatory approach is a significant factor in its lagging AI adoption. The upcoming EU AI Act, set to take effect in 2026, introduces a stringent four-tier risk classification system with fines of up to 7% of global turnover for non-compliance. While the Act includes regulatory sandboxes aimed at fostering innovation, its complexity and strict compliance measures are causing hesitation among firms.

John Salmon, Partner at Hogan Lovells, warned, “History tells us that, in most cases, regulation of tech tends to hinder innovation rather than help.” In contrast, the US, with its more flexible and fragmented regulatory environment, allows for faster and broader AI adoption.

Data Management: A Core Challenge

Beyond regulation, data management issues further hinder Europe’s AI progress. Ivan Lantanision, Chief Product Officer at Allvue, noted, “It’s only as good as the data that you feed it. One of the most critical initiatives that companies have for AI to be useful is a data management or data management governance program to get the most out of it.”

A 2024 Allvue report highlighted that 65% of GPs struggle with data accuracy and aggregation, while 58% prioritize data collection and reporting. Poor data infrastructure and fragmented systems limit the effectiveness of AI initiatives across Europe.

The US Advantage: Scale, Culture, and Investment

Several key factors give the US a competitive edge in AI adoption:

Market Scale: The expansive US market naturally drives firms to scale operations and adopt advanced technologies.

Tax Incentives: Owen Pagan pointed out, “The US tax regime provides higher returns than Europe, leading firms to be more open-minded about adopting technology.”

Robust Infrastructure: Significant investments by US tech giants have built a stronger foundation for AI innovation.

Cultural Mindset: Lantanision remarked, “A lot of firms are starting to explore AI that don’t maybe fully understand how they should use it or how it could benefit them,” reflecting the US’s willingness to experiment and iterate.

The Growing Gap

The gap between Europe and the US in AI adoption is widening. While American firms move swiftly to integrate AI across operations, European GPs remain cautious, hindered by regulatory complexity and data management challenges. This hesitation threatens Europe’s position in the global private equity landscape.

With the EU AI Act approaching, European firms must balance compliance with innovation. Failure to act now could deepen the divide and limit growth opportunities.

The US is pulling ahead in AI adoption, leaving Europe at risk of falling behind. Regulatory barriers, data management issues, and cultural caution are slowing European GPs in embracing transformative AI technologies. Without decisive action, European private equity firms may struggle to compete on the global stage.

As Owen Pagan emphasized, technology is essential for scaling operations and maintaining growth. Europe must find a way to accelerate AI adoption or risk being left behind in the race for innovation.