Deep Portfolio Insights

Value Creation, Supercharged by AI.

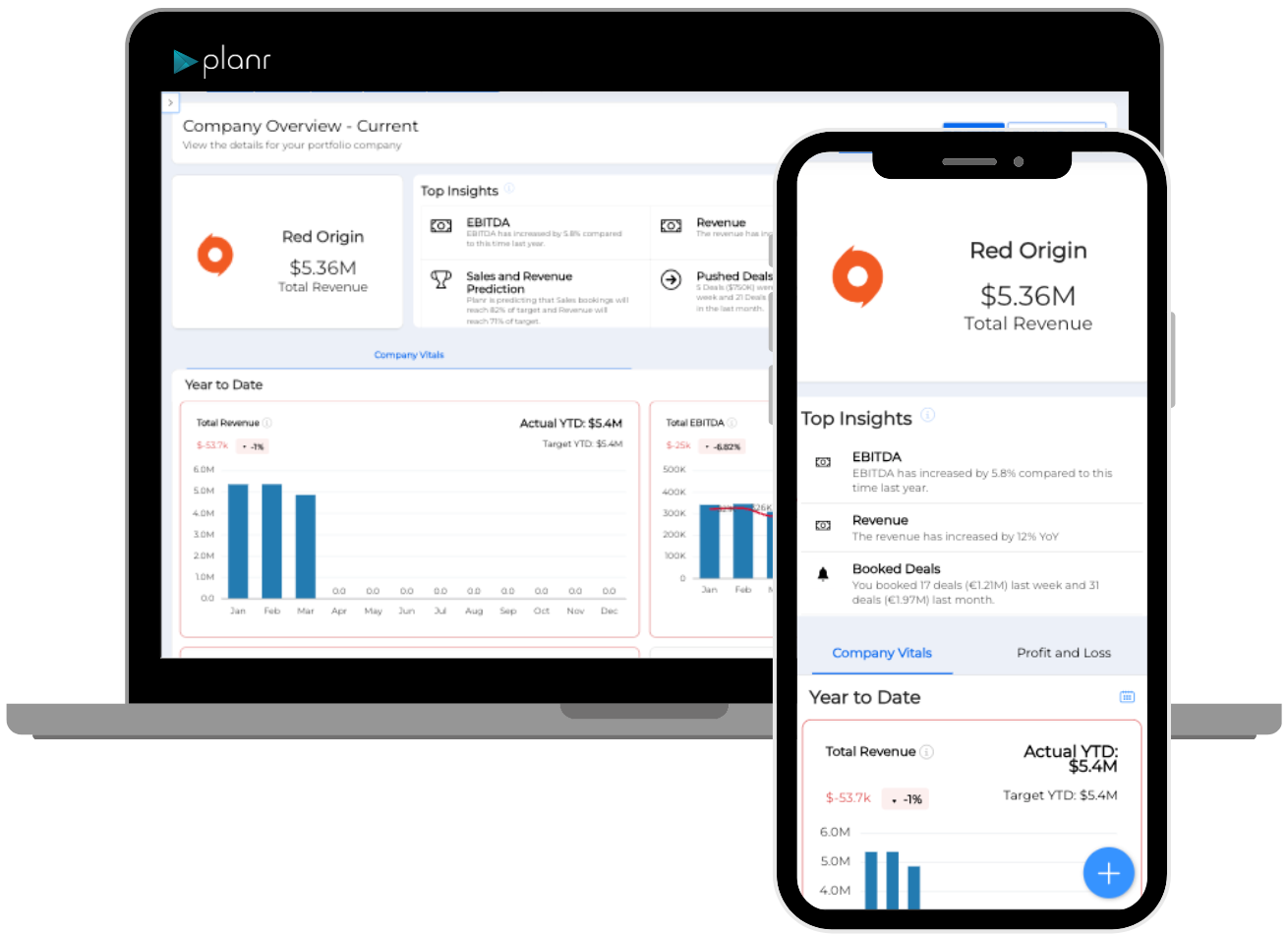

Stop chasing reports and piecing together fragmented data. Planr automates portfolio monitoring, giving you a real-time, 360° view of fund and company performance—without the manual work.

The Old Way vs. The Planr Way

The old way of portfolio monitoring slows you down with backward looking reports. Planr puts you ahead with real-time insights, AI-driven forecasting, and seamless collaboration – so you can act, not react.

Legacy Tools

- Data is fragmented across multiple systems, making it difficult to get a clear picture.

- Reports are static and backward-looking, offering little predictive value.

- Limited visibility into pipeline health and revenue conversion rates.

- Financial forecasting lacks precision and requires heavy manual work.

- Teams rely on spreadsheets and manual calculations, increasing errors and inefficiencies.

- Decision-making is reactive, responding to risks only after they impact returns.

- A single source of truth for fund & portco performance, centralizing financial, operational, and sales data.

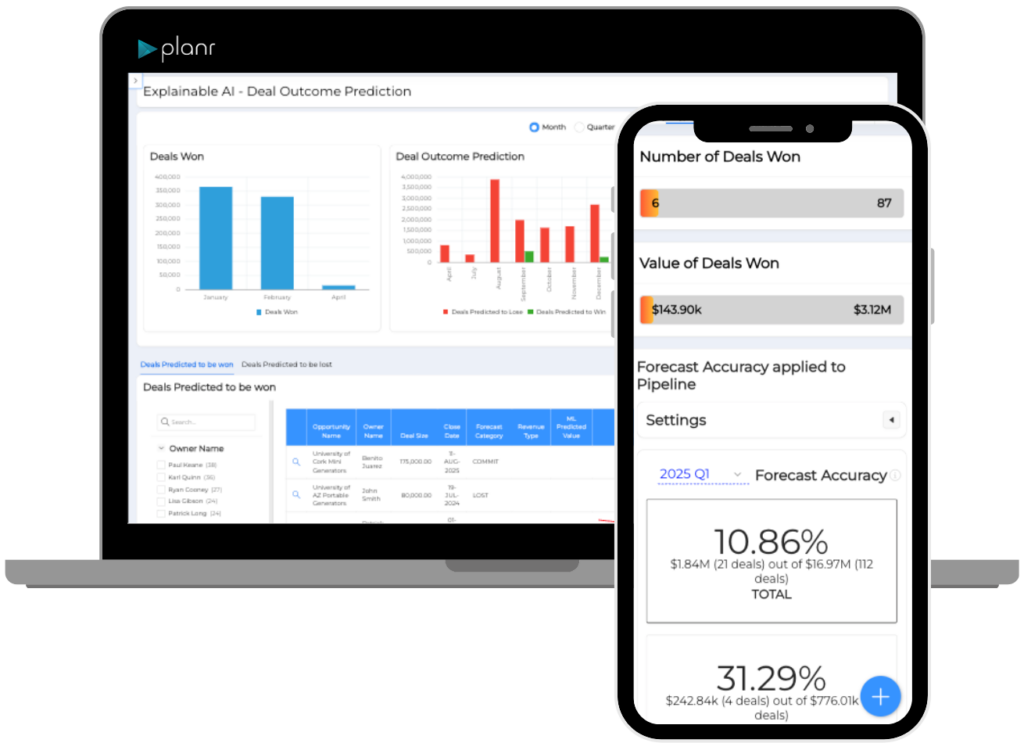

- Live, AI-powered insights that predict future performance, revenue trends, and sales momentum.

- Full pipeline view, conversion tracking, and revenue forecasting to optimize capital allocation.

- AI-driven models predict bookings, revenue, and cash flow with unparalleled accuracy.

- Automated data flows, real-time dashboards, and smart recommendations eliminate manual work.

- Proactive alerts and AI-powered risk detection ensure early intervention and opportunity identification.

Value Creation Through AI-Driven Insights

With AI-powered revenue intelligence, Planr enables you to track, compare, and optimize every aspect of portfolio company performance—from pipeline health to revenue realization. Identify risks, enhance efficiency, and drive stronger returns with real-time insights that go beyond basic reporting.

- Sales & Revenue Growth: Gain a full pipeline view and track pipeline coverage, deal progression, and revenue shifts to improve go-to-market strategies.

- Operational Efficiency: Identify bottlenecks, inefficiencies, and underperforming divisions with granular tracking of conversion rates, forecast accuracy, and time to close across portfolio companies.

- Optimized Capital Allocation: Analyze deal sources, revenue by lead channel, and bookings-to-cash trends to prioritize high-impact investments.

- Benchmarking & Competitive Edge: Compare company, sector, and fund performance against historical and peer benchmarks, leveraging AI-driven deal comparison and pushed deal analysis to stay ahead.

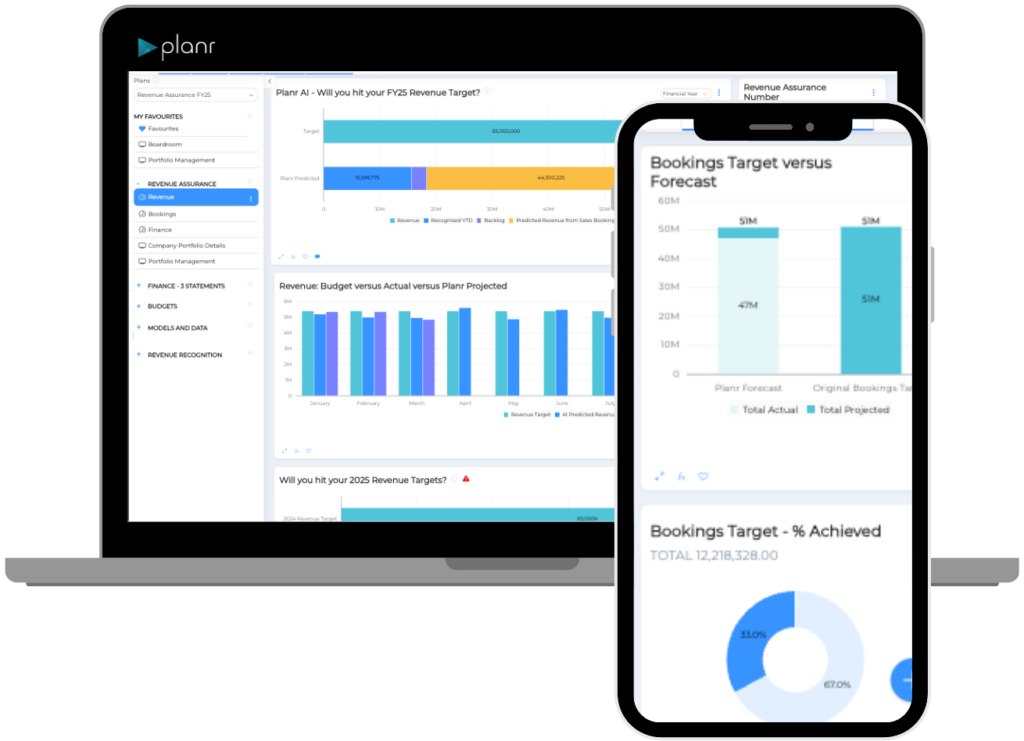

- Revenue Assurance & Forecasting: Automate revenue recognition, improve forecast accuracy, and track bookings-to-cash cycles to ensure consistent, predictable returns.

Proactive Portfolio Optimization, Not Reactive Reporting

Most platforms tell you what happened—Planr tells you what’s coming next. With AI-driven alerts, predictive modeling, and real-time insights, Planr ensures you stay ahead of performance shifts, mitigate risks before they impact returns, and make smarter, data-driven decisions – faster.

- AI-Powered Risk Warnings: Get real-time alerts on revenue declines, sales slowdowns, and financial risks—before they impact returns.

- Customizable Performance Tracking: Monitor key financial, operational, and sales KPIs—tailored to your fund, sector, and portfolio strategy.

- Dynamic Forecasting & Scenario Modeling: Simulate future outcomes, test investment strategies, and model revenue scenarios before making key decisions.

- Deal & Sales Pipeline Monitoring: Track pipeline coverage, deal progression, rep performance, and forecast accuracy across all portfolio companies.

- Portfolio-Wide Early Warning System: Detect underperformance, stalled deals, and inefficiencies early—so you can take action before targets are missed.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making