Automate Valuations

AI-Powered Valuations: Faster, Smarter, More Reliable.

Valuations shouldn’t slow you down. Planr automates the entire valuation process—removing manual inputs, reducing errors, and ensuring portfolio-wide consistency. With AI-driven fair value assessments, real-time scenario modeling, and seamless audit-ready reporting, you can trust your numbers and move faster.

The Old Way vs. The Planr Way

No more delays. No more inconsistencies. Just accurate, up-to-date valuations powered by real-time financial, operational, and market data.

Traditional Valuations

- Manual data collection across multiple sources leads to delays and errors.

- Valuation models are inconsistent across portfolio companies.

- Scenario modeling requires extensive spreadsheets and complex calculations.

- Limited visibility into assumptions, methodologies, and audit trails.

- Adjusting valuations to market changes is slow and reactive.

- Automated data ingestion ensures real-time updates and eliminates manual work.

- Standardized methodologies ensure portfolio-wide accuracy and comparability.

- AI-driven modeling enables instant simulations of different valuation outcomes.

- Audit-ready reporting with full data transparency and compliance tracking.

- Live data integration ensures real-time adjustments based on financial and market conditions.

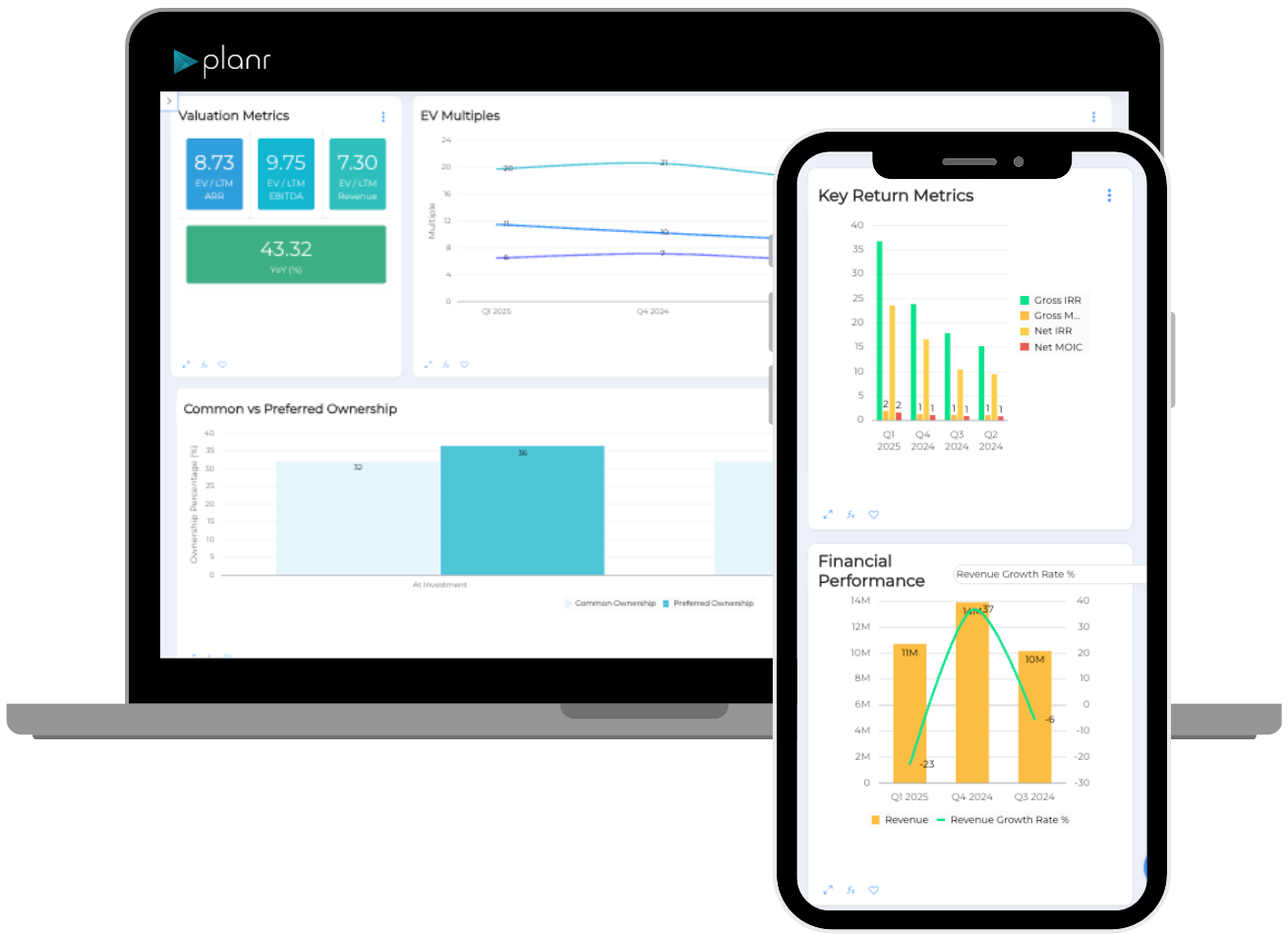

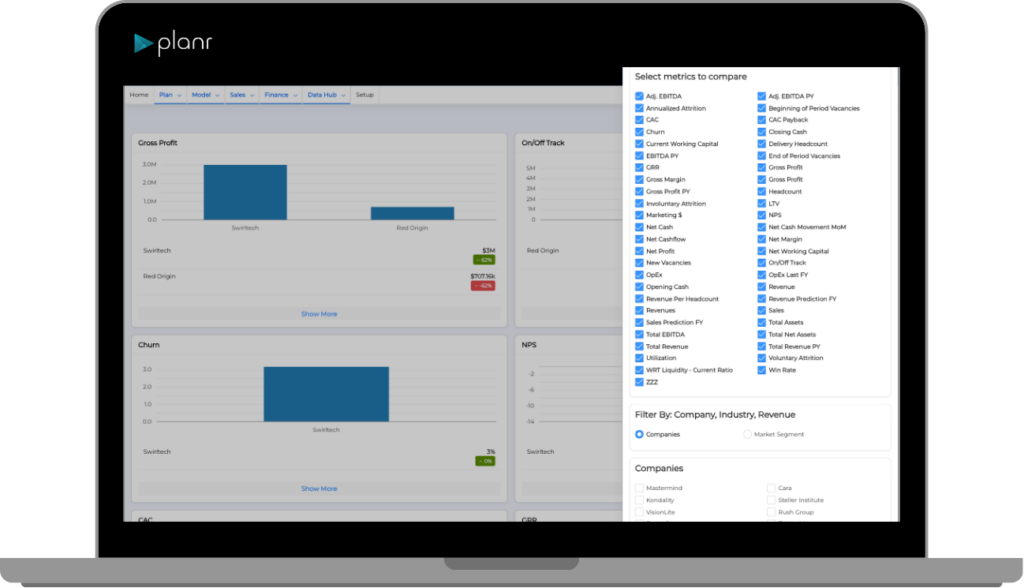

Automate & Standardize Valuations Across Your Portfolio

With Planr’s AI-powered valuation tools, you get a single source of truth—eliminating discrepancies and ensuring accurate, data-driven assessments across all portfolio companies.

- AI-Driven Fair Value Assessments: Automate valuations with real-time data, eliminating guesswork and manual calculations.

- Scenario Modeling & Sensitivity Analysis: Instantly model different valuation outcomes based on changing financial and market conditions.

- Portfolio-Wide Consistency: Standardize valuation methodologies across all portfolio companies for reliable, comparable insights.

- Automated Period-End Valuations: Streamline monthly and quarterly valuations, reducing bottlenecks and last-minute data scrambles.

- Real-Time Data Syncing: Pull valuation data directly from your financial, operational, and market sources—ensuring always up-to-date valuations.

- Direct Integrations with Excel & Reporting Tools: Update valuation models dynamically and export fully formatted reports with a single click.

Eliminate Manual Work. Improve Accuracy. Move Faster.

Planr ensures your valuation process is not just compliant—but smarter, faster, and more actionable.

- No more spreadsheet headaches—centralized valuation models ensure consistency across funds and portfolio companies.

- No more last-minute surprises—real-time valuations mean you’re always prepared for reporting cycles.

- No more delays—automated processes cut period-end valuation workflows from weeks to hours.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making