Fund & Company Forecasting

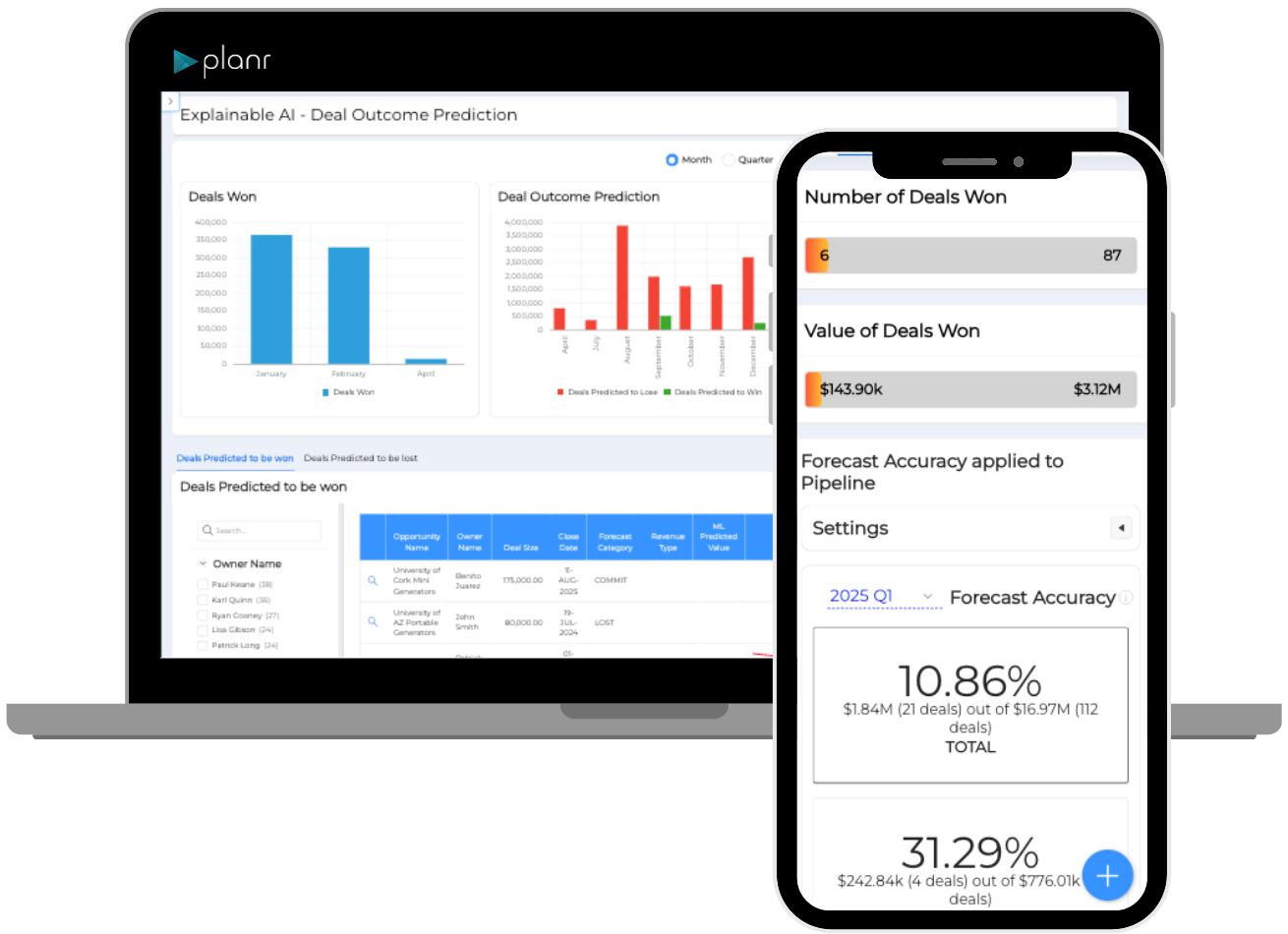

AI-Powered Forecasting: No More Surprises at Board Meetings

Stop relying on outdated spreadsheets and backward-looking reports. Planr transforms forecasting into a real-time, AI-driven process, ensuring you always know what’s ahead—before it happens.

The Old Way vs. The Planr Way

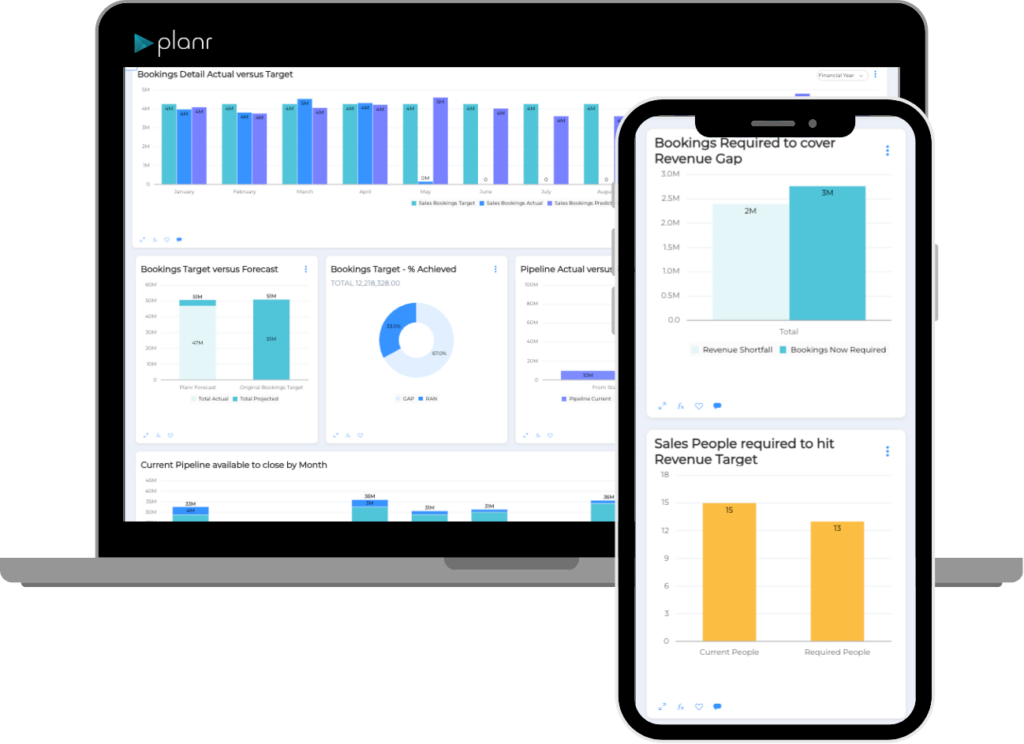

With predictive modeling at both the company and fund level, you can track revenue, sales, and cash flow across individual portfolio companies and seamlessly roll up forecasts into a full-fund performance projection. Drill into company, division, or product-level data to uncover growth opportunities, potential risks, and capital inefficiencies—instantly.

Traditional Forecasting

- Revenue, cash flow, and sales projections are manual, slow, and prone to error.

- Forecasts are based on historical data alone, leading to reactive decision-making.

- No unified view—company-level forecasts don’t roll up into an accurate fund-wide outlook.

- No way to drill into revenue sources or operational drivers at a granular level.

- Capital allocation is based on gut feel rather than data-driven insights.

- AI-driven forecasting eliminates guesswork and updates in real-time.

- Predict future performance with real-time financial, operational, and sales data.

- Seamlessly roll up individual company forecasts into a fund-level performance projection.

- Drill down into revenue streams, product lines, sales regions, and deal sources to identify growth drivers.

- AI highlights risk, opportunity, and optimal investments, ensuring smarter capital allocation.

Granular Forecasting Across Every Level of Your Portfolio

With Planr’s AI-powered forecasting tools, you get a 360° predictive view of financial performance – at both the company and fund level.

- AI-Powered Forecasting: Predict revenue, sales, and cash flow at the company level, then roll up into a fund-wide performance forecast.

- Scenario Planning in Real-Time Test different investment and operational strategies with live scenario modeling—see how changes impact fund performance before making a move.

- Portfolio-Wide Visibility with Drill-Downs View high-level fund forecasts while drilling down into individual company, division, product, or sales team performance to pinpoint key revenue drivers.

- Data-Driven Capital Allocation AI-powered insights highlight where to invest, where to pull back, and which opportunities maximize returns.

- Predictive Revenue & Bookings Projections Analyze revenue trajectories, booking trends, and future cash flow positions with AI-powered predictive analytics.

- Automatic Revenue Recognition (Rev Rec) Forecast with precision by automatically recognizing revenue across multiple revenue types and financial models.

- Slice & Dice Functionality Easily segment forecasts by region, product, revenue type, or team—ensuring a fully customizable, data-driven approach to fund management.

Drill Into Performance. Optimize Growth. Act with Confidence.

Most platforms tell you what happened—Planr tells you what’s coming next. With AI-driven alerts, predictive modeling, and real-time insights, Planr ensures you stay ahead of performance shifts, mitigate risks before they impact returns, and make smarter, data-driven decisions – faster.

- No more reactive forecasting—AI highlights trends and risks before they impact fund performance

- No more spreadsheet headaches—centralized financial, sales, and revenue forecasting in one platform.

- No more uncertainty—real-time scenario modeling gives you the clarity and confidence to act fast.

- No more surface-level reports—drill into the numbers to see exactly what’s driving performance at every level.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making