Investment Benchmarking

Smarter Comparisons, Sharper Decisions

Investment benchmarking shouldn’t be a guessing game. Stop relying on outdated industry reports and backward-looking metrics. Planr’s Investment Benchmarking delivers real-time, AI-driven insights, allowing you to compare portfolio performance against industry benchmarks, peer groups, and custom KPIs.

The Old Way vs. The Planr Way

With automated data aggregation and AI-powered analytics, you can measure financial performance, operational efficiency, and value creation across companies, funds, and sectors. Know where your portfolio stands – and where it can outperform.

Traditional Benchmarking

- Comparisons are based on stale, months-old data.

- Industry reports and spreadsheets make data fragmented and hard to analyze.

- Benchmarks are limited to static peer group comparisons.

- Identifying trends requires manual analysis and deep data dives.

- Decision-making is reactive, based on past performance reports.

- Real-time benchmarking ensures up-to-date performance tracking.

- Automated data aggregation centralizes financial, operational, and market data.

- Custom KPIs allow tailored benchmarking to align with investment strategy.

- AI-powered trend detection highlights performance shifts and risk indicators instantly.

- Proactive insights ensure early action on risks and opportunities.

How Planr Elevates Investment Benchmarking

With AI-driven benchmarking, Planr enables you to track, compare, and optimize portfolio performance in real time. Measure against industry peers, analyze historical trends, and drill into key metrics to drive smarter investment decisions and maximize returns.

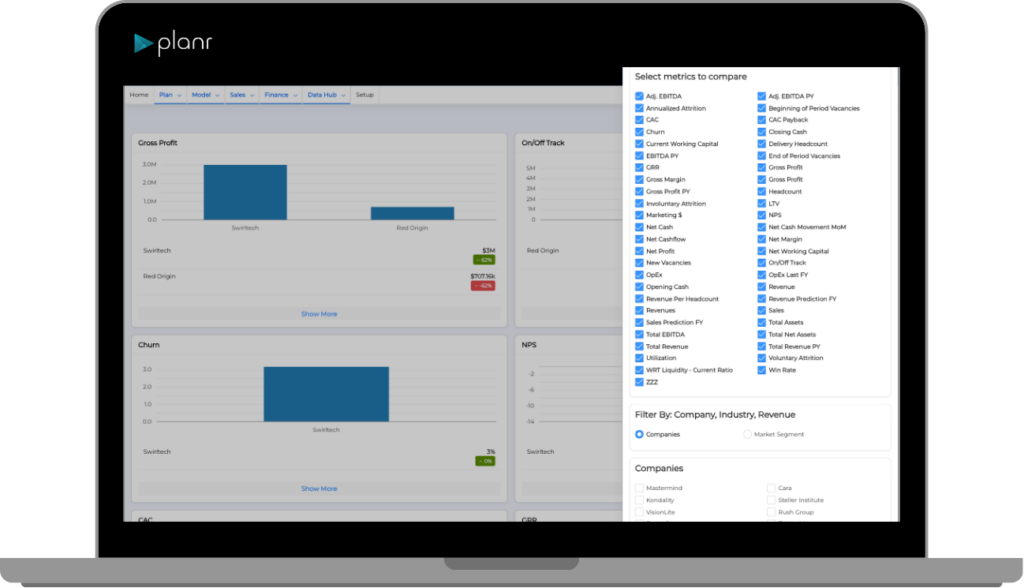

- Industry & Peer Comparisons: Compare portfolio company performance against industry averages, sector benchmarks, and competitor trends in real time.

- Real-Time Portfolio Insights: Track financial, operational, and market trends across your investments with always up-to-date data.

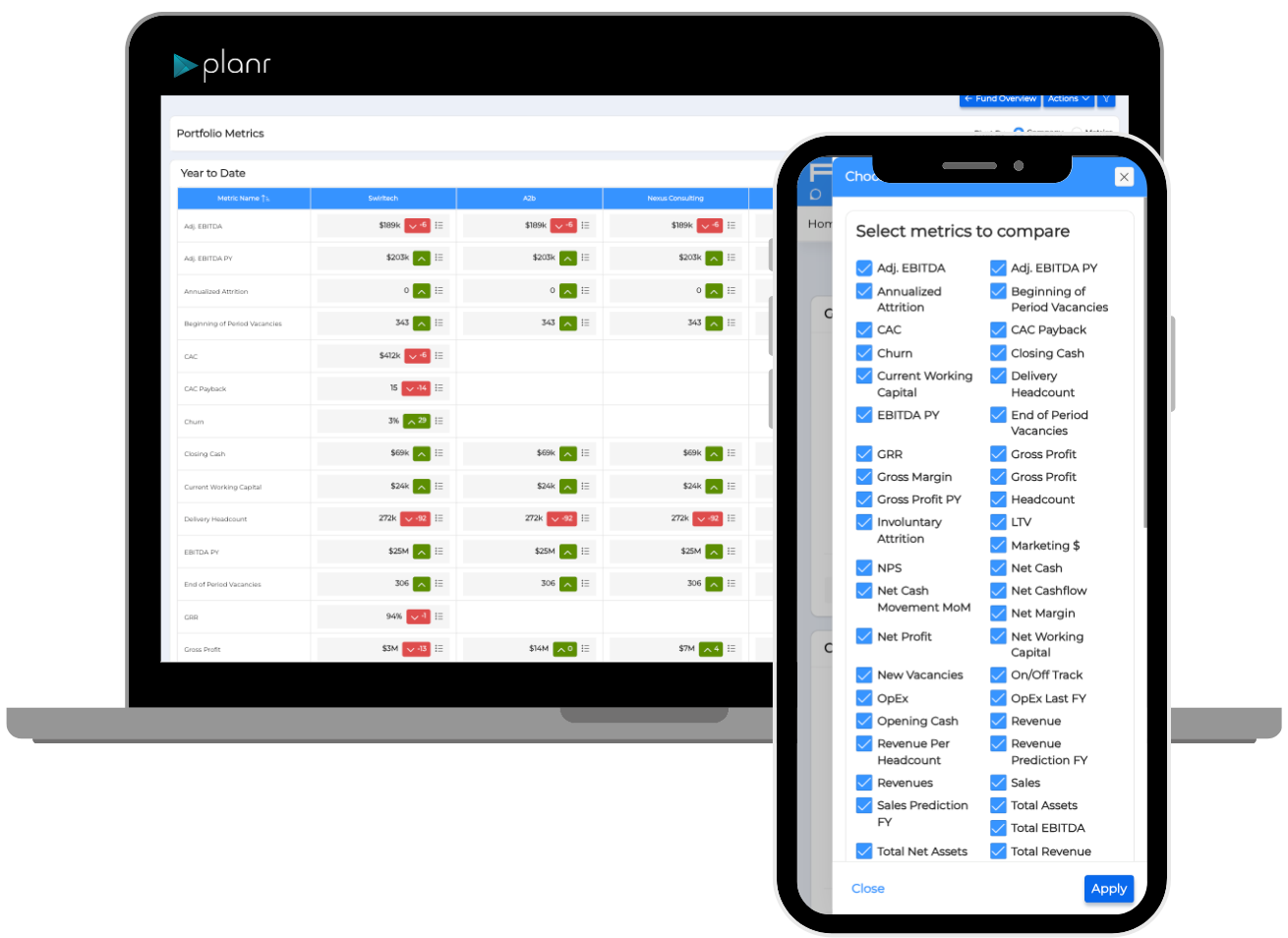

- Customizable Performance Metrics: Define and monitor KPIs that align with your investment strategy, value creation goals, and sector priorities.

- AI-Powered Trend Analysis: Identify emerging risks and opportunities before they impact portfolio performance.

- Fund & Portfolio-Level Benchmarking: Drill down into company, fund, or sector performance, ensuring a granular view of key drivers.

- Historical Performance Tracking: Compare current performance vs. past benchmarks to assess growth, stability, and long-term trends.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making