Managed Data Services

The Foundation for Smarter Decisions

Your data is only as valuable as its accuracy, structure, and accessibility. Whether you need standardized reporting across an entire portfolio or a tailored solution for a single company, Planr’s Managed Data Services provide a fully customizable framework to solve complex data challenges.

Tailored Data Solutions for Funds & Portfolio Companies

We don’t just collect data—we refine, validate, and structure it to deliver decision-ready insights that drive value creation. With a fully customizable approach, Planr integrates directly into your existing workflows, ensuring seamless data submission, automated processing, and continuous optimization. No more chasing teams, fixing errors, or dealing with outdated reports. Your data works for you, not against you.

Seamless Data Submission

Ensuring smooth data flow starts with seamless submission. Planr MDS standardizes and automates data intake, allowing funds and portfolio companies to submit financials, KPIs, and operational metrics effortlessly—whether through direct integrations, templates, or a secure web portal.

- Portfolio companies submit financials, KPIs, and operational data via spreadsheets, templates, integrations, or a web portal.

- A structured SLA defines roles, responsibilities, and reporting timelines across PE funds, portcos, and Planr.

- Ensure smooth, standardized data collection without disrupting existing workflows.

Automated Data Processing

Data integrity is the foundation of reliable reporting. Planr’s AI-powered engine automatically cleans, validates, and structures incoming data, eliminating errors and ensuring consistency across financial, operational, and investor reports—so every decision is backed by accurate, real-time insights.

- AI-driven validation instantly detects inconsistencies, duplicates, and missing data.

- Standardized data structuring aligns all submissions for seamless reporting and analysis.

- Enrichment tools enhance data quality, ensuring accuracy before it reaches dashboards.

Ongoing Maintenance & Optimization

Keeping data clean isn’t a one-time task—it’s an ongoing process. Planr continuously monitors, refines, and enhances your data framework to adapt to shifting reporting needs. From regulatory updates to evolving LP expectations, we ensure your data remains accurate, structured, and primed for decision-making.

- Continuous monitoring ensures data remains clean, updated, and compliant.

- Adaptive frameworks evolve with changing LP, regulatory, and internal reporting needs.

- Data governance protocols maintain integrity across all financial, operational, and market insights.

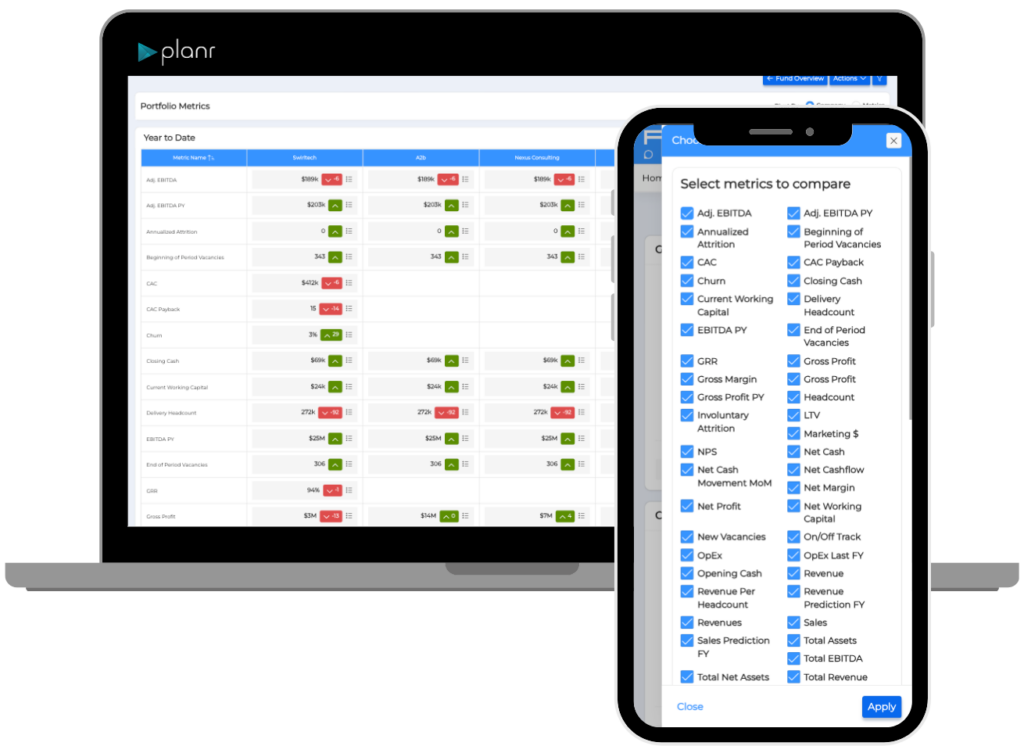

What You Can Do With Planr MDS

We don’t just collect data—we refine, validate, and structure it to deliver decision-ready insights that drive value creation. With a fully customizable approach, Planr integrates directly into your existing workflows, ensuring seamless data submission, automated processing, and continuous optimization. No more chasing teams, fixing errors, or dealing with outdated reports. Your data works for you, not against you.

- Standardized Fund-Level Reporting: Ensure seamless data aggregation across all portfolio companies, providing a single source of truth for fund performance.

- Company-Specific Data Optimization: Solve complex data challenges for individual portfolio companies, from CRM-to-ERP integrations to KPI standardization.

- Automated Data Validation & Enrichment: AI-driven processing eliminates errors, fills in gaps, and ensures consistency across financial, operational, and investor reports.

- Seamless System Integrations: Connect financials, sales data, and operational metrics across multiple systems—eliminating silos and manual uploads.

- Ongoing Monitoring & Governance: Your reporting needs evolve—Planr ensures your data remains accurate, audit-ready, and investment-grade at all times.

How Planr MDS Delivers Value

Planr MDS isn’t just a data service – it’s a strategic advantage. By eliminating manual inefficiencies and ensuring data integrity, you will drive measurable impact across funds and portfolio companies.

- Faster Reporting Cycles: Reduce time spent on manual data collection and consolidation.

- Confident Decision-Making: Work with clean, structured, and real-time insights.

- Enhanced Collaboration: Eliminate data silos between funds, portcos, and internal teams.

- Scalability & Flexibility: Easily integrate new acquisitions and evolving data requirements.

- Audit-Ready Compliance: Maintain a clear, traceable record of financial and operational data.

See How Planr MDS Transforms Your Data

Managing portfolio and company data shouldn’t be a bottleneck. Experience how Planr’s Managed Data Services eliminate manual data wrangling, enhance reporting accuracy, and streamline decision-making.

- A hands-on walkthrough: Discover how Planr MDS standardizes and optimizes financial, operational, and investor reporting.

- Live demo of integrations & setup: See how we seamlessly connect with your existing systems, from ERPs to CRMs and 100s of other data sources.

- Tailored discussion: Explore how Planr MDS adapts to your fund or portfolio company’s unique data challenges.

- Expert guidance, no hard sell: Get insights from specialists who understand private equity and portfolio data needs.

- Client success stories: Learn how leading funds and companies use Planr MDS to ensure clean, structured, and decision-ready data.