2024 Insight Survey:

Advancing Portfolio Monitoring in Private Equity Firms

This survey aims to explore the current landscape of portfolio monitoring within private equity firms. Your insights will contribute to a comprehensive industry research report on portfolio monitoring practices and the future outlook in 2024.

- Confidentiality and Anonymity: Your participation in this study is completely anonymous, and all data collected will be kept strictly confidential. Your responses will be aggregated with those of other participants, ensuring that individual responses cannot be identified.

- Time Commitment: The survey will take approximately 2 minutes to complete. We understand that your time is valuable, and we greatly appreciate your contribution.

- Valuable Insights: By participating in this study, you will contribute to the development of industry knowledge and gain access to the findings, which will provide you with valuable insights into the current challenges, opportunities, and potential of AI-driven approaches in value creation within private equity portfolio companies.

- Filter By

- Guides & Whitepapers

- Insights

- Media & News

- Unlocking Growth

- What's New

- Filter By

- Guides & Whitepapers

- Insights

- Media & News

- Unlocking Growth

- What's New

LP Reporting Automation: The Complete Guide for Private Equity Firms

LP reporting has become the silent bottleneck in private equity operations. While firms have digitized deal sourcing and fund administration, quarterly LP reporting remains stubbornly manual for most firms.

LP reporting automation isn’t about eliminating the human element from investor communications. Rather, it’s about removing manual, repetitive tasks from the reporting process so your team can focus on analysis, customization, and relationship building.

AI-Powered Portfolio Monitoring for Private Equity: Complete Guide (2025)

82% of PE firms now use AI for portfolio monitoring. Learn how to reduce reporting time by 40% and gain real-time visibility.

If you’re still wrestling with spreadsheets for portfolio monitoring, manually chasing down performance data, or scrambling to pull together LP reports at quarter-end, you’re not just behind the curve. You’re operating with a fundamental disadvantage against firms that have real-time visibility into every portfolio company.

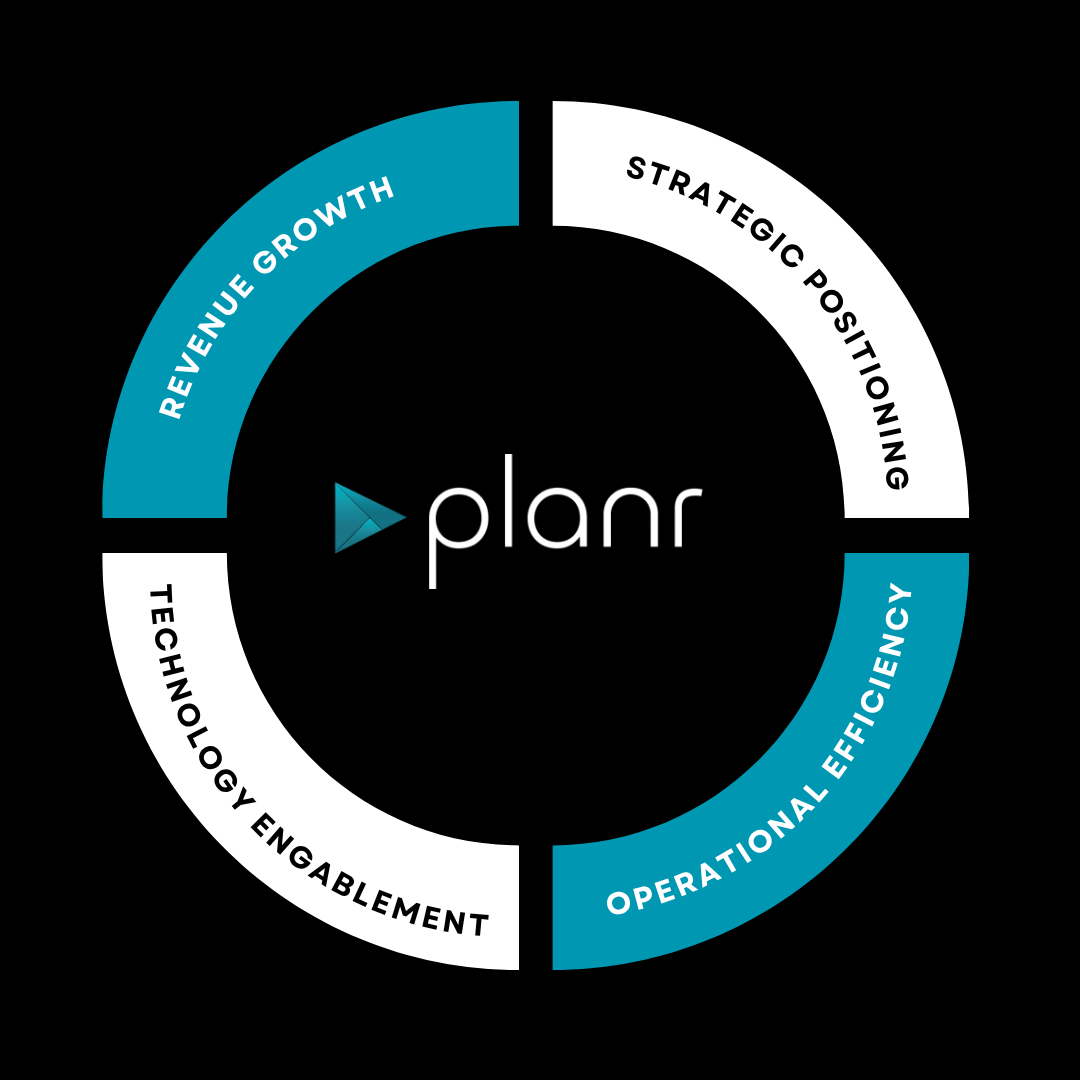

The Four Pillars Powering Value Creation in Modern Private Equity

Leading firms are no longer content with tracking performance — they’re leveraging enterprise-grade systems and AI that create performance engines. The next era of value creation will be powered by AI and driven by four core pillars.