2024 Insight Survey:

Advancing Portfolio Monitoring in Private Equity Firms

This survey aims to explore the current landscape of portfolio monitoring within private equity firms. Your insights will contribute to a comprehensive industry research report on portfolio monitoring practices and the future outlook in 2024.

- Confidentiality and Anonymity: Your participation in this study is completely anonymous, and all data collected will be kept strictly confidential. Your responses will be aggregated with those of other participants, ensuring that individual responses cannot be identified.

- Time Commitment: The survey will take approximately 2 minutes to complete. We understand that your time is valuable, and we greatly appreciate your contribution.

- Valuable Insights: By participating in this study, you will contribute to the development of industry knowledge and gain access to the findings, which will provide you with valuable insights into the current challenges, opportunities, and potential of AI-driven approaches in value creation within private equity portfolio companies.

- Filter By

- Insights

- Media & News

- Unlocking Growth

- What's New

- Whitepapers

- Filter By

- Insights

- Media & News

- Unlocking Growth

- What's New

- Whitepapers

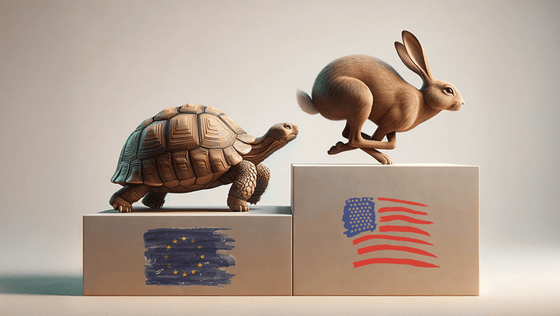

Bridging The AI Gap in Private Equity: USA vs Europe

European private equity firms are falling behind the US in AI adoption, hindered by strict regulations and data management challenges. With the EU AI Act on the horizon, the gap is widening—threatening Europe’s global competitiveness.

Ultimate Buyer’s Guide for Portfolio Management Systems in Private Equity

Download Buyer’s Guide Executive Summary Traditional systems and processes that rely on Excel and PowerPoint are no longer sufficient. Firms need tools that not only …

Finalists at the 2024 Drawdown Awards for the Second Year Running

Planr Named Finalist at the 2024 Drawdown Awards for the Second Year Running We are excited to share that we have been named a finalist …