Insights

Portfolio Monitoring Tools Shouldn’t Dictate Tech Stacks

Your competitive edge isn’t built on what systems your portcos use. It’s built on how fast you can turn their data — any data — into action.

PE's are ditching rigid Tools for

flexible, system-agnostic data infrastructure.

Most portfolio companies won’t use the same systems. And that’s okay — until your platform makes it a problem.

Rigid tools assume standardization. They rely on all portcos using the same CRM, the same ERP, the same finance or HR stack.

But that’s not reality.

Modern portfolios are a patchwork of platforms.

And the more you try to force uniformity, the more resistance you meet.

Here’s where the friction shows up:

When your tools demand specific formats or manual exports, portco teams become default data processors — not business drivers. You’re not enabling better decisions. You’re just adding overhead.

Portcos shouldn’t feel pressured to rip and replace tools that work for their business just to fit a fund’s template. But when platforms are inflexible, that’s exactly what happens — and it slows everyone down.

You can’t model portfolio-wide insights if half your portcos are invisible because their data “doesn’t fit.” And worse — the fund ends up making decisions based on partial truths, incomplete trends, or delayed inputs.

Being system-agnostic doesn’t mean compromising.

It means unlocking flexibility.

Modern PE funds are not compromising on a system that suits some. They’re embracing platforms that:

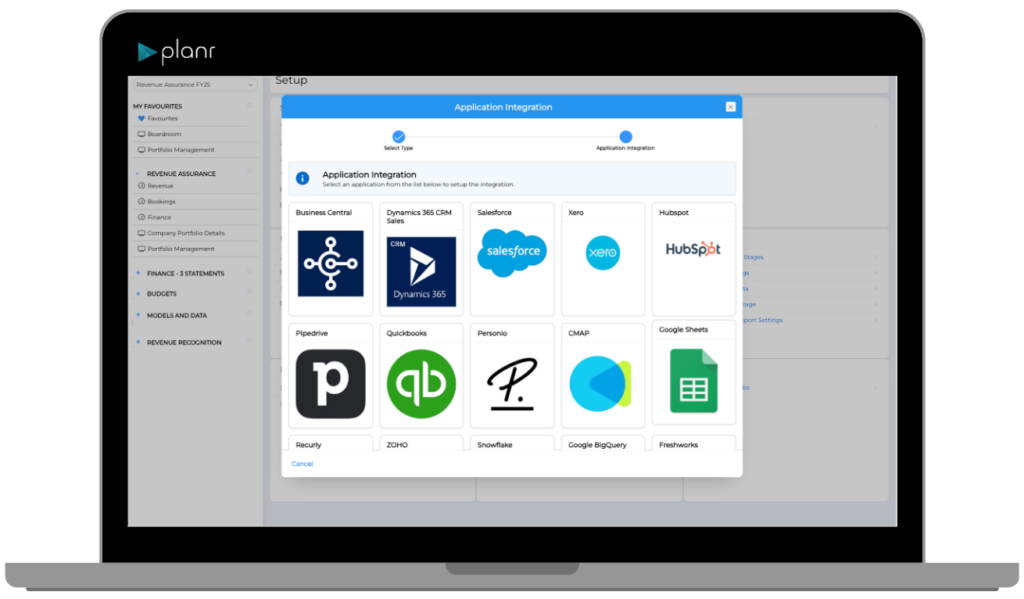

- Accept data from any source: whether that’s Salesforce, NetSuite, HubSpot, Xero, SAP, Excel, or even flat files.

- Cleanse, map & align metrics automatically: so you get consistency without forcing uniformity.

- Work with the tools portcos already use : so you minimize disruption and maximize collaboration.

- Let you drill into insights directly: without relying on a single source of truth to be the only one.

Any System. Any Format.

One Source of Truth.

Planr was built from day one to be data-agnostic.

No clunky integrations. No format gymnastics. Just a clean, connected view of performance, wherever the data lives.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making