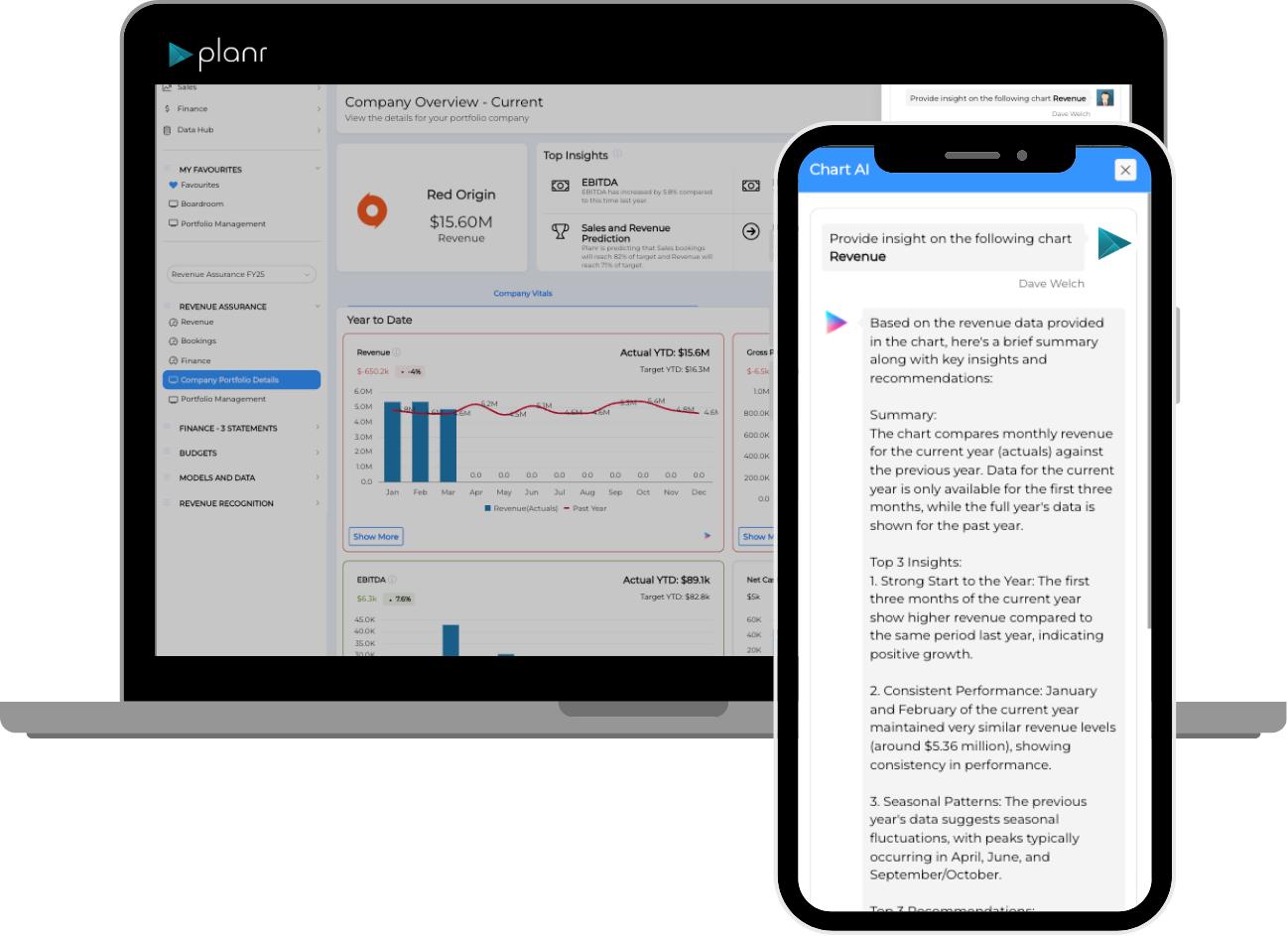

The AI-Powered Platform for Private Equity

From Insights to Action - Faster, Smarter, & Fully Automated

Private equity demands precision, speed, and deep visibility. Yet, most funds still rely on outdated spreadsheets, siloed data, and static reports that limit decision-making and slow down value creation.

Planr changes that. Our AI-driven platform centralizes your portfolio’s financial, operational, and commercial data into a single, real-time intelligence engine—so you can track performance, forecast with confidence, and optimize investments effortlessly.

Purpose-Built for Private Equity. Powered by AI.

From deal teams to CFOs, investor relations to portfolio operations, Planr ensures every stakeholder across the fund has the right data at the right time—without the manual work. Whether you’re sourcing deals, managing portfolio company performance, forecasting fund-wide returns, or responding to investor requests, Planr centralizes financial, operational, and commercial data into a single AI-powered platform—so every team can work smarter, faster, and with complete confidence in the numbers.

Real-Time Portfolio Monitoring

Know where your fund and portfolio companies stand instantly. AI-powered analytics track financials, sales, cash flow, and operations—no more waiting for reports.

Deep Portfolio Insights

Unlock hidden value across your portfolio. AI-driven analytics reveal performance trends, revenue blockers, and inefficiencies—enabling you to take action before they affect returns.

AI-Driven Forecasting

No more guesswork. Predict revenue, sales, and cash flow at the company level—then roll up insights into a single, fund-wide forecast, giving visibility into risks and opportunities.

Automated Valuations

Eliminate errors and inconsistencies. AI-driven valuations ensure real-time accuracy, transparency, and compliance so you can trust the numbers behind every investment.

Investment Benchmarking

Measure what matters. Compare fund and portfolio performance against industry, historical, and peer benchmarks to identify opportunities for value creation.

Effortless LP Reporting

Automate investor updates. No more last-minute data scrambles—Planr’s reporting suite dynamically updates as new data flows in, keeping LPs informed and engaged.

Why Private Equity Firms Trust Planr

Stop wrestling with disconnected systems. Planr unifies your financial, operational, and sales data by integrating directly with your existing tech stack—eliminating silos, reducing manual work, and delivering real-time, AI-powered intelligence across your entire portfolio.

- Real-Time Data, Not Outdated Reports – Always know where your portfolio stands.

- AI That Works for You – Move beyond static reporting with automated insights and predictive analytics.

- Fund & Company-Wide Oversight – Drill down from fund-level trends to individual deal performance.

- Faster, More Accurate Reporting – LPs and stakeholders get instant, audit-ready updates.

- Built for Private Equity – Not another static tool—Planr is designed for the complexity of PE.

Built for the Future of Private Equity

We love Planr’s configurability and integration capabilities and we are increasingly looking to leverage the intelligent analytics layer.

For any tool to be useful, it has to be a real part of the day-to-day workflow. Planr is becoming the enabler for all of that. Whether it’s reporting to investors or managing day-to-day operations, having up-to-date performance data at our fingertips is critical.

Anup Hira

Partner & Value Creation Team Lead

The detailed insights and predictions have not only enhanced our strategic planning but have also been instrumental in maintaining a 30% YoY revenue growth rate. Planr has brought a new level of sophistication to our sales and revenue operations. As we shifted market focus, getting forecast predictability was vital.

We were able to access insights that are impossible to get from Salesforce.

David Beausang

VP Sales & Customer Success

Planr has shifted our behaviour in Calligo. If we are at risk of missing a revenue target, I know about it. I now have the insights and time to intervene and course correct before our sales or revenue performance is impacted.

Using Planr we have an objective view of the impact of decisions taken across the business on sales and revenue performance and its future trajectory.

Julian Box

Chief Exective Officer

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making