Insights

Portfolio Monitoring Templates Are Fine...Until They're Not

Modern PE funds are moving beyond templated reporting for faster, clearer, more actionable insights.

Templates aren’t the enemy. They’re just not enough anymore.

For many funds, templates are the default way to collect portfolio company data. They’re familiar, repeatable, and offer a sense of control.

But here’s the problem:

They give the illusion of structure — without the clarity you actually need.

Templates often surface headline figures but miss the context beneath them. Definitions vary. Inputs are often subjective or manually manipulated — sometimes unintentionally — and that subjectivity quietly moves through the system.

By the time numbers reach the fund level, everyone’s working off a version of the truth… but not the truth.

For portco teams, monthly templates mean hours of wrangling internal data into a format someone else wants. That’s time not spent improving operations or executing strategy.

At the fund level, analysts don’t get clean, timely data. They get spreadsheets that need cleaning, validating, reformatting, and explaining — before any real analysis can begin.

By the time insights are surfaced?

The moment to act has already passed.

Once a template is filled out and passed along, what happens next? Was a number edited? Was a definition misaligned? Did one portco calculate Gross Margin differently?

There’s no visibility.

No traceability.

And no proactive warning before things go off course.

Templating isn't broken. It's just outdated.

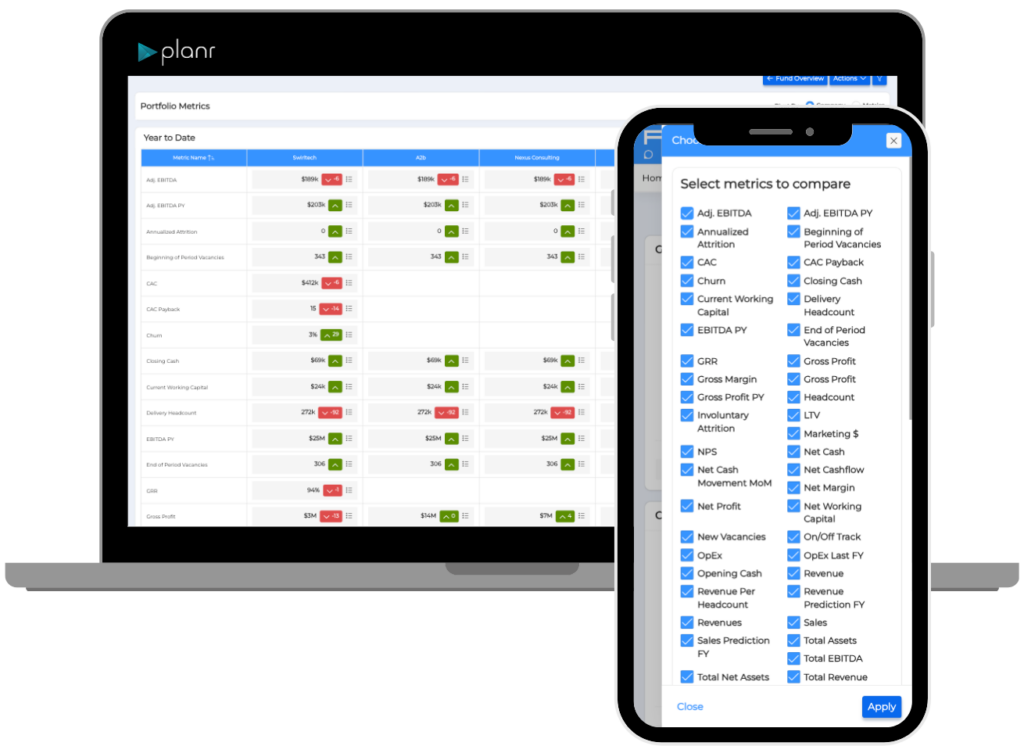

Modern PE funds are evolving. They’re not rejecting structure — they’re redefining it. With smarter systems that:

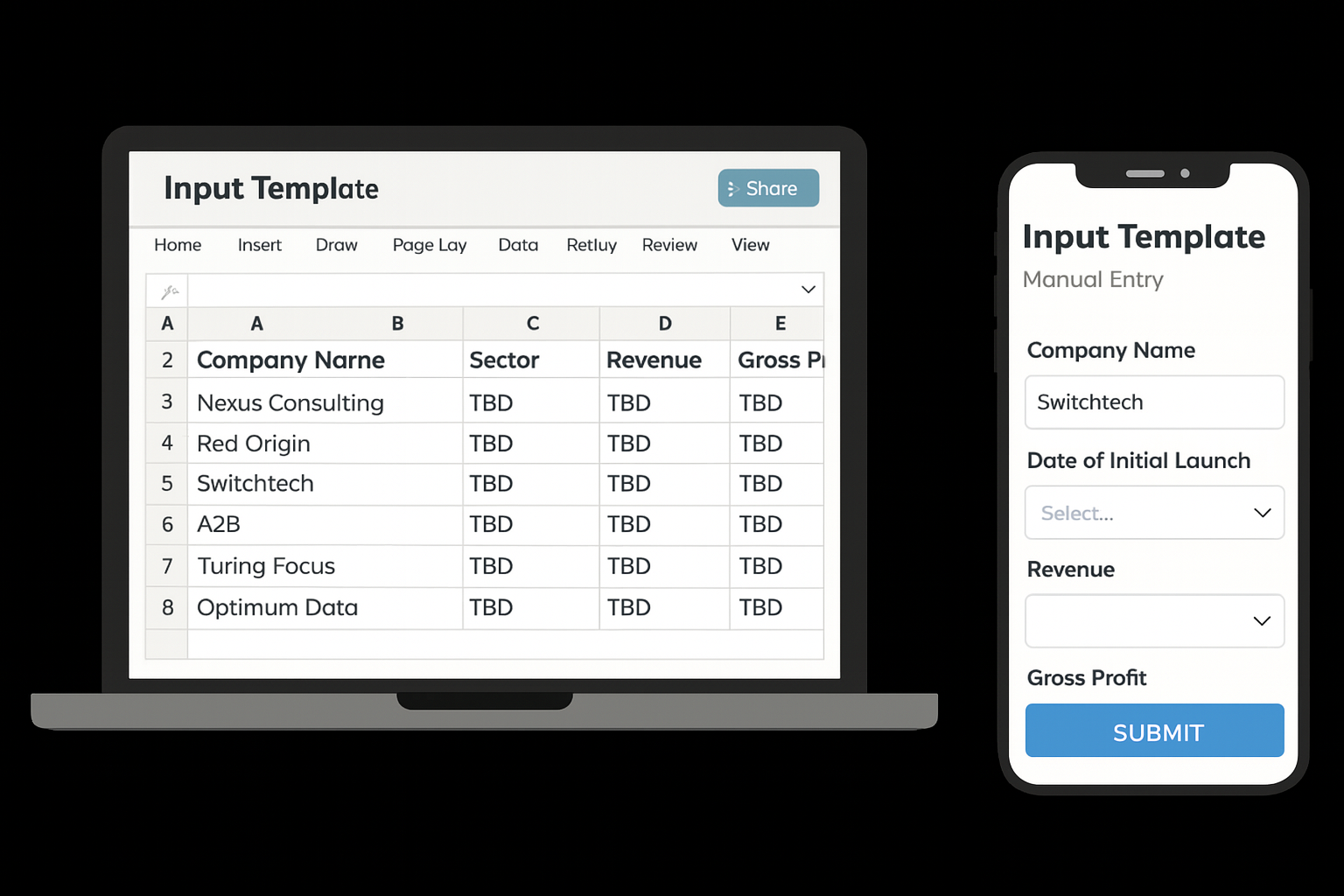

- Ingest data as it exists: whether from CRM, ERP, finance platforms or PDFs

- Standardize metrics automatically: so definitions stay aligned.

- Offer an audit trail : so you can trace every number back to its source

- Surface trends live: so you don’t just see the problem, you catch it early

Templates will always feel safe.

But insight doesn’t live in Cell F29.

Templates will always feel safe. But insights don’t live in Cell F29.Value creation lives in the ability to zoom in, ask questions, and uncover what’s changing — before the board asks you. Ditch the rework. Keep the rigor.

Planr gives you structured, auditable insights across your portfolio — without relying on fragile templates or lagging workflows.

See Planr in Action

Private equity is evolving – don’t get left behind. Experience how AI-powered insights drive better reporting, smarter decisions, and proactive portfolio management.

- A hands-on walkthrough: Experience Planr’s AI-powered insights tailored to your portfolio.

- Live demo of integrations & setup: See how Planr seamlessly connects with your existing systems.

- Discussion built around your priorities: Explore how Planr fits your specific needs and challenges.

- Expert guidance, no hard sell: Get your questions answered by industry specialists.

- Client use cases: See how top firms leverage Planr to streamline portfolio monitoring and decision-making