Download Buyer's Guide

Executive Summary

Traditional systems and processes that rely on Excel and PowerPoint are no longer sufficient. Firms need tools that not only provide a historical view but also offer real-time insights and predictive analytics to drive future performance.

Key Features to Look For:

- Data Ingestion & Integration: Support for various data types, real-time processing, and seamless integration with existing systems.

- Data Management: Automated data collection, normalization, and comprehensive audit trails to ensure data consistency and security

- Financial Management: Multi-entity support, flexible account mapping, consistent reporting, and automated reconciliation.

- Reporting & Analytics: Customizable reports and dashboards, AI-driven insights, ad-hoc reporting, and compliance with regulatory standards.

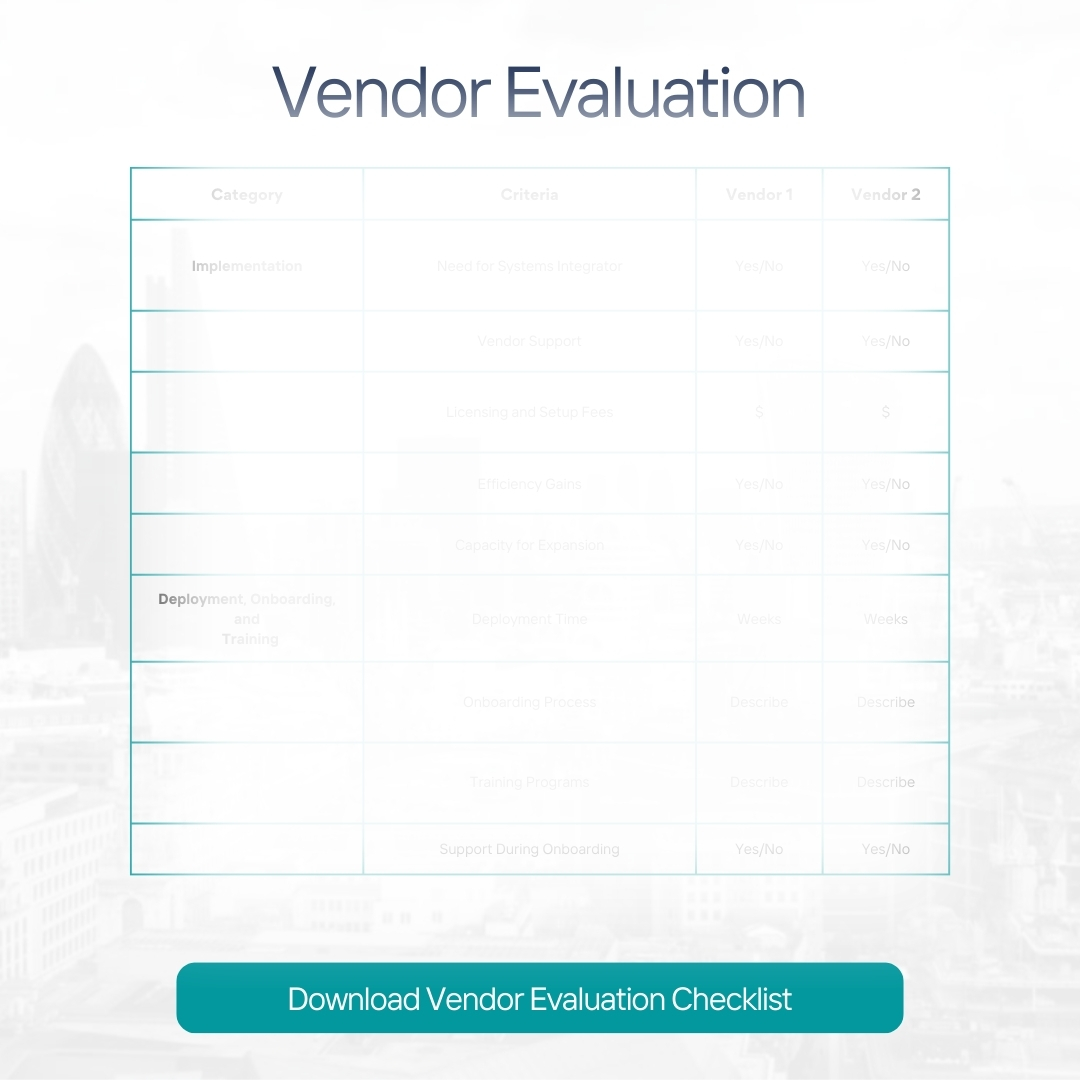

- Implementation & Support: Quick deployment, minimal downtime, scalability, and robust vendor support during onboarding and beyond.

This guide includes a detailed evaluation template to help firms systematically assess and compare different portfolio management systems, ensuring they choose a solution that meets their specific needs now and into the future.

Adopting an advanced portfolio management system is not just a technological upgrade; it is a strategic imperative for staying competitive in the fast-paced world of private equity.