The Four Pillars Powering Value Creation in Modern Private Equity

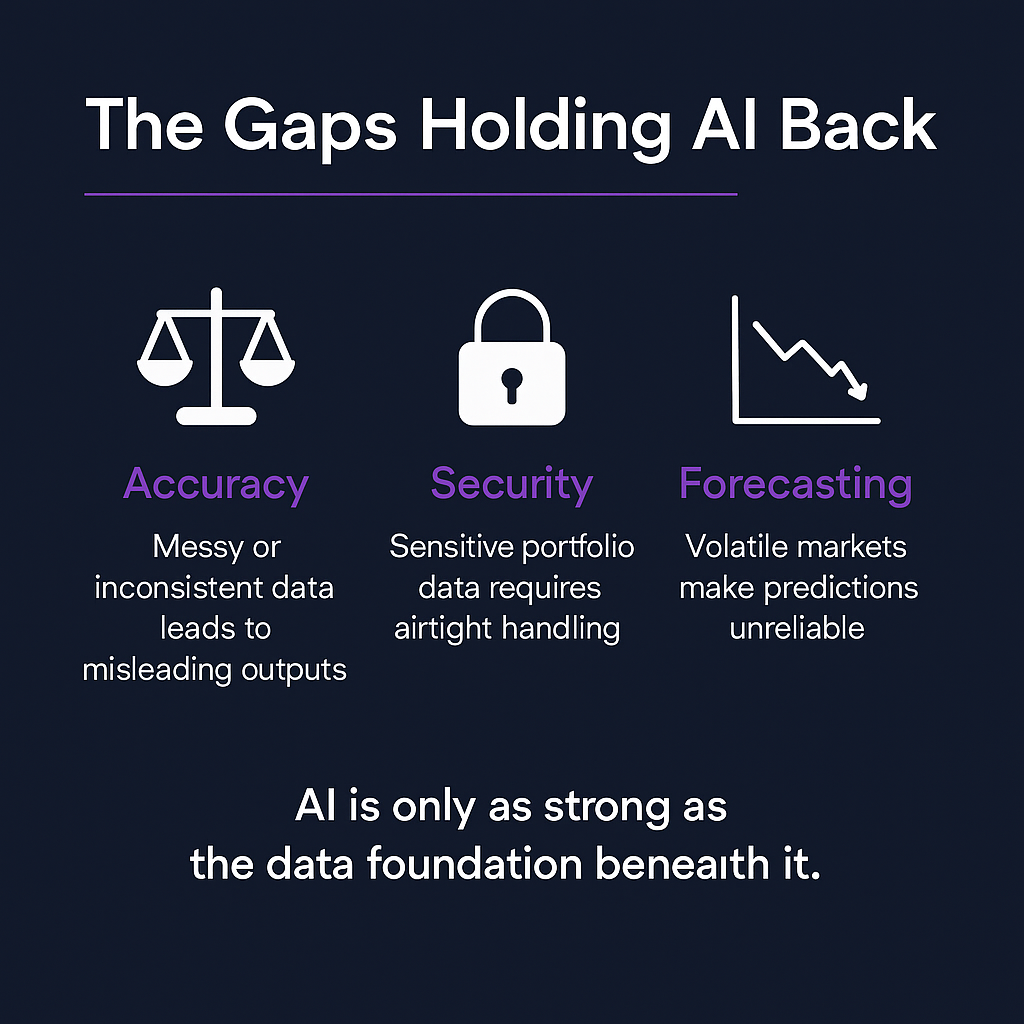

Leading firms are no longer content with tracking performance — they’re leveraging enterprise-grade systems and AI that create performance engines. The next era of value creation will be powered by AI and driven by four core pillars.

The Four Pillars Powering Value Creation in Modern Private Equity Read More »